Form 941 First Quarter Deadline is April 30, 2021.

E-File Now

Form 1099-NEC Mailing

Address

This article covers the following topics:

- Mailing Address of Form 1099-NEC

- Advantages of E-filing over Paper filing

- File Form 1099-NEC in less than 5 minutes

Mailing Address for Form

1099-NEC

Updated on November 08, 2024 - 1:30 AM by Admin, ExpressEfile

If you are thinking about paper filing Form 1099-NEC this year, there’s a lot to take into consideration. Explore the following topics to get prepared, determine your IRS mailing address, and make the right decision for your business.

Read on to learn more about the Form 1099-NEC Mailing Address.

1. Mailing Address of Form 1099-NEC

Employers use Form 1099-NEC to report payments of over $600 to independent contractors or other nonemployees. Previously, nonemployee compensation was reported on Box 7 of Form 1099-MISC, but the IRS has recently released Form 1099-NEC to replace that option. The IRS address you should mail Form 1099-NEC to depends on your state. Here is your state-by-state address guide:

The IRS address you should mail Form 1099-NEC to depends on your state. Here is your

state-by-state address guide:

| If your principal business,office or agency, or legal residence (for individuals), is located in | Mail Form 1099-NEC to |

|---|---|

Alabama, Arizona, Arkansas, Delaware, Florida, Georgia, Kentucky, Maine, Massachusetts, Mississippi, New Hampshire, New Jersey, New Mexico, New York, North Carolina, Ohio, Texas, Vermont, Virginia |

Department of the Treasury, The IRS strongly encourages filers to e-file Form 1099-NEC for a quick processing. |

|

Alaska, Colorado, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Michigan, Minnesota, Missouri, Montana, Nebraska, Nevada, North Dakota, Oklahoma, Oregon, South Carolina, South Dakota, Tennessee, Utah, Washington, Wisconsin, Wyoming |

Department of the Treasury, The IRS strongly encourages filers to e-file Form 1099-NEC for a quick processing. |

|

California, Connecticut, District of Columbia, Louisiana, Maryland, Pennsylvania, Rhode Island, West Virginia |

Department of the Treasury, To get instant status of your returns filed with the IRS, choose to e-file Form 1099-NEC. |

| Outside the United States | Department of the Treasury, Internal Revenue Service Center, Austin,TX 73301. |

2. Form 1099-NEC filing Deadline

Payers who have paid nonemployees as a compensation of $600 or more during the year should

file Form 1099-NEC. Also, copies of the form must be sent to the recipients before the deadline. Below is the

deadline for Form 1099-NEC:

| Description | Deadline |

|---|---|

Paper Filing |

January 31, 2025 |

Sending Recipient Copies |

January 31, 2025 Have us mail your recipient copies when you e-file with us. |

E-Filing |

January 31, 2025 E-File Now |

3. Form 1099-NEC Filing Methods

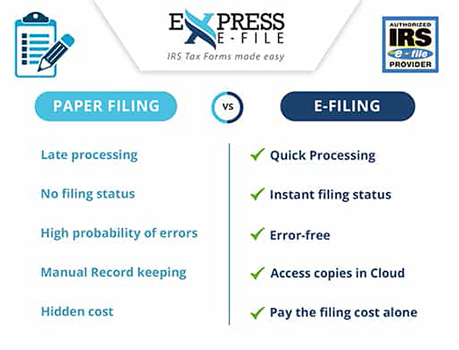

The IRS recommends that employers e-file Form 1099-NEC. E-filing is the easiest way to complete your forms and makes your filing process faster, safer, and more efficient. Since e-filing cuts down on processing time, you’ll hear back from the IRS more quickly. You can track your returns easily and get instant notifications on your filing status.

Paper filing Form 1099-NEC is more difficult and takes longer. When you paper file, you don’t have ExpressEfile’s tax software checking your return for errors. If you do notice a mistake, it can be hard to correct it on a paper return.

When you paper file, you do cut out e-filing fees, but do you actually save your business money? Printing, envelopes, and postal mailing costs add up without providing you any protection against errors and expensive IRS penalties.

Below is the advantages of e-filing over paper filing.

4. File Form 1099-NEC in less than 5 minutes

With ExpressEfile, you can e-file Form 1099-NEC for as low as $1.49/form (very less compared to paper filing). Our in-built audit check ensures error-free filing and you'll also get filing status instantly. ExpressEfile lets you choose to opt for postal mailing of recipients.

- 1. Enter the form information

- 2. Review the form

- 3. Transmit Form 1099-NEC directly to the IRS

It’ll take only a few minutes