Mailing Address for Form 941

Paper filing your Form 941 return is a more complicated process than it seems to be. Take a look at the following topics to get a comprehensive understanding of the things you need to know before paper filing a Form 941 return. There is also a set of instructions provided on how and where to mail 941.

The Form 941 mailing address depends on:

- The state in which your business operates

- Whether payment is included with Form 941 or not.

The table below contains the 941 mailing address for 2025:

Tip: Press ‘Ctrl’ and ‘F’ simultaneously, and enter the state name for the mailing address you are looking for.

| If You’re In | Mail Return Without Payment | Mail Return With Payment |

|---|---|---|

|

Connecticut |

Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0005 |

Internal Revenue Service PO Box 806532 Cincinnati, OH 45280-6532 |

|

Delaware |

Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0005 |

Internal Revenue Service PO Box 806532 Cincinnati, OH 45280-6532 |

|

District of Columbia |

Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0005 |

Internal Revenue Service PO Box 806532 Cincinnati, OH 45280-6532 |

|

Georgia |

Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0005 |

Internal Revenue Service PO Box 806532 Cincinnati, OH 45280-6532 |

|

Illinois |

Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0005 |

Internal Revenue Service PO Box 806532 Cincinnati, OH 45280-6532 |

|

Indiana |

Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0005 |

Internal Revenue Service PO Box 806532 Cincinnati, OH 45280-6532 |

|

Kentucky |

Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0005 |

Internal Revenue Service PO Box 806532 Cincinnati, OH 45280-6532 |

|

Maine |

Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0005 |

Internal Revenue Service PO Box 806532 Cincinnati, OH 45280-6532 |

|

Maryland |

Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0005 |

Internal Revenue Service PO Box 806532 Cincinnati, OH 45280-6532 |

|

Massachusetts |

Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0005 |

Internal Revenue Service PO Box 806532 Cincinnati, OH 45280-6532 |

|

Michigan |

Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0005 |

Internal Revenue Service PO Box 806532 Cincinnati, OH 45280-6532 |

|

New Hampshire |

Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0005 |

Internal Revenue Service PO Box 806532 Cincinnati, OH 45280-6532 |

|

New Jersey |

Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0005 |

Internal Revenue Service PO Box 806532 Cincinnati, OH 45280-6532 |

|

New York |

Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0005 |

Internal Revenue Service PO Box 806532 Cincinnati, OH 45280-6532 |

|

North Carolina |

Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0005 |

Internal Revenue Service PO Box 806532 Cincinnati, OH 45280-6532 |

|

Ohio |

Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0005 |

Internal Revenue Service PO Box 806532 Cincinnati, OH 45280-6532 |

|

Pennsylvania |

Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0005 |

Internal Revenue Service PO Box 806532 Cincinnati, OH 45280-6532 |

|

Rhode Island |

Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0005 |

Internal Revenue Service PO Box 806532 Cincinnati, OH 45280-6532 |

|

South Carolina |

Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0005 |

Internal Revenue Service PO Box 806532 Cincinnati, OH 45280-6532 |

|

Tennessee |

Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0005 |

Internal Revenue Service PO Box 806532 Cincinnati, OH 45280-6532 |

|

Vermont |

Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0005 |

Internal Revenue Service PO Box 806532 Cincinnati, OH 45280-6532 |

|

Virginia |

Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0005 |

Internal Revenue Service PO Box 806532 Cincinnati, OH 45280-6532 |

|

West Virginia |

Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0005 |

Internal Revenue Service PO Box 806532 Cincinnati, OH 45280-6532 |

|

Wisconsin |

Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0005 |

Internal Revenue Service PO Box 806532 Cincinnati, OH 45280-6532 |

|

Alabama |

Department of the Treasury Internal Revenue Service Ogden, UT 84201-0005 |

Internal Revenue Service P.O. Box 932100 Louisville, KY 40293-2100 |

|

Alaska |

Department of the Treasury Internal Revenue Service Ogden, UT 84201-0005 |

Internal Revenue Service P.O. Box 932100 Louisville, KY 40293-2100 |

|

Arizona |

Department of the Treasury Internal Revenue Service Ogden, UT 84201-0005 |

Internal Revenue Service P.O. Box 932100 Louisville, KY 40293-2100 |

|

Arkansas |

Department of the Treasury Internal Revenue Service Ogden, UT 84201-0005 |

Internal Revenue Service P.O. Box 932100 Louisville, KY 40293-2100 |

|

California |

Department of the Treasury Internal Revenue Service Ogden, UT 84201-0005 |

Internal Revenue Service P.O. Box 932100 Louisville, KY 40293-2100 |

|

Colorado |

Department of the Treasury Internal Revenue Service Ogden, UT 84201-0005 |

Internal Revenue Service P.O. Box 932100 Louisville, KY 40293-2100 |

|

Florida |

Department of the Treasury Internal Revenue Service Ogden, UT 84201-0005 |

Internal Revenue Service P.O. Box 932100 Louisville, KY 40293-2100 |

|

Hawaii |

Department of the Treasury Internal Revenue Service Ogden, UT 84201-0005 |

Internal Revenue Service P.O. Box 932100 Louisville, KY 40293-2100 |

|

Idaho |

Department of the Treasury Internal Revenue Service Ogden, UT 84201-0005 |

Internal Revenue Service P.O. Box 932100 Louisville, KY 40293-2100 |

|

Iowa |

Department of the Treasury Internal Revenue Service Ogden, UT 84201-0005 |

Internal Revenue Service P.O. Box 932100 Louisville, KY 40293-2100 |

|

Kansas |

Department of the Treasury Internal Revenue Service Ogden, UT 84201-0005 |

Internal Revenue Service P.O. Box 932100 Louisville, KY 40293-2100 |

|

Louisiana |

Department of the Treasury Internal Revenue Service Ogden, UT 84201-0005 |

Internal Revenue Service P.O. Box 932100 Louisville, KY 40293-2100 |

|

Minnesota |

Department of the Treasury Internal Revenue Service Ogden, UT 84201-0005 |

Internal Revenue Service P.O. Box 932100 Louisville, KY 40293-2100 |

|

Mississippi |

Department of the Treasury Internal Revenue Service Ogden, UT 84201-0005 |

Internal Revenue Service P.O. Box 932100 Louisville, KY 40293-2100 |

|

Missouri |

Department of the Treasury Internal Revenue Service Ogden, UT 84201-0005 |

Internal Revenue Service P.O. Box 932100 Louisville, KY 40293-2100 |

|

Montana |

Department of the Treasury Internal Revenue Service Ogden, UT 84201-0005 |

Internal Revenue Service P.O. Box 932100 Louisville, KY 40293-2100 |

|

Nebraska |

Department of the Treasury Internal Revenue Service Ogden, UT 84201-0005 |

Internal Revenue Service P.O. Box 932100 Louisville, KY 40293-2100 |

|

Nevada |

Department of the Treasury Internal Revenue Service Ogden, UT 84201-0005 |

Internal Revenue Service P.O. Box 932100 Louisville, KY 40293-2100 |

|

New Mexico |

Department of the Treasury Internal Revenue Service Ogden, UT 84201-0005 |

Internal Revenue Service P.O. Box 932100 Louisville, KY 40293-2100 |

|

North Dakota |

Department of the Treasury Internal Revenue Service Ogden, UT 84201-0005 |

Internal Revenue Service P.O. Box 932100 Louisville, KY 40293-2100 |

|

Oklahoma |

Department of the Treasury Internal Revenue Service Ogden, UT 84201-0005 |

Internal Revenue Service P.O. Box 932100 Louisville, KY 40293-2100 |

|

Oregon |

Department of the Treasury Internal Revenue Service Ogden, UT 84201-0005 |

Internal Revenue Service P.O. Box 932100 Louisville, KY 40293-2100 |

|

South Dakota |

Department of the Treasury Internal Revenue Service Ogden, UT 84201-0005 |

Internal Revenue Service P.O. Box 932100 Louisville, KY 40293-2100 |

|

Texas |

Department of the Treasury Internal Revenue Service Ogden, UT 84201-0005 |

Internal Revenue Service P.O. Box 932100 Louisville, KY 40293-2100 |

|

Utah |

Department of the Treasury Internal Revenue Service Ogden, UT 84201-0005 |

Internal Revenue Service P.O. Box 932100 Louisville, KY 40293-2100 |

|

Washington |

Department of the Treasury Internal Revenue Service Ogden, UT 84201-0005 |

Internal Revenue Service P.O. Box 932100 Louisville, KY 40293-2100 |

|

Wyoming |

Department of the Treasury Internal Revenue Service Ogden, UT 84201-0005 |

Internal Revenue Service P.O. Box 932100 Louisville, KY 40293-2100 |

Where to mail Form 941 for non-profits?

| If You’re In | Mail Return Without Payment | Mail Return With Payment |

|---|---|---|

|

Special filing address for exempt organizations; governmental entities; and Indian tribal governmental entities; regardless of location |

Department of the Treasury Internal Revenue Service Ogden, UT 84201-0005 |

Internal Revenue Service P.O. Box 932100 Louisville, KY 40293-2100 |

Where to mail Form 941 if you have no legal residence or principal place of business?

| If You’re In | Mail Return Without Payment | Mail Return With Payment |

|---|---|---|

|

No legal residence or principal place of business in any state, including employers in American Samoa, Guam, the CNMI, the USVI, and Puerto Rico |

Internal Revenue Service PO Box 409101 Ogden, UT 84409 |

Internal Revenue Service P.O. Box 932100 Louisville, KY 40293-2100 |

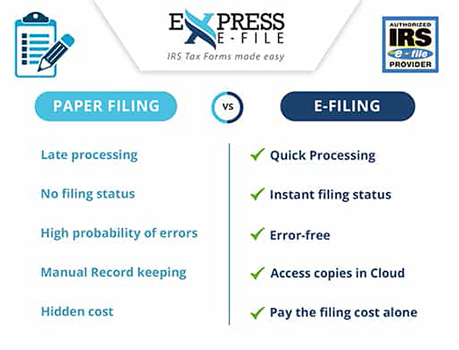

1. What does the IRS recommend?

The IRS recommends you to e-file Form 941 return as it is easier. The e-file method not only makes the filing process quicker but also gets your return status instantly. As an employer, you will find it simple to file your Form 941 returns and pay tax dues.

The table shows a comprehensive advantage of e-filing over paper filing.

| Feature | Mailing | E-Filing |

|---|---|---|

|

Processing Time |

4-6 weeks |

Instant confirmation |

|

Error Checking |

Error Checking |

Built-in validation checks |

|

Convenience |

Requires printing and postage |

File from anywhere, anytime |

|

Security |

Risk of lost or delayed mail |

Secure, encrypted submission |

Regardless of the method you choose to file Form 941, make sure you stick to the correct 941 deadline to stay compliant with the IRS.

2. Switch to E-File Today and Get Your Filing Done in less than 5 minutes

Get started with TaxBandits, an IRS-authorized e-file provider and ExpressEfile’s trusted partner to securely e-file Form 941 on time with the IRS.

TaxBandits makes your e-filing process effortless, even if it’s your first time filing 941 electronically. In addition, you can also make your tax payments with TaxBandits EFTPS payment solution.

Get Started Now