Changes in Form 941 for

1st Quarter 2021

This article covers the following topics:

E-File Form 941 with ExpressEfile in 3 simple steps and get the

filing status instantly.

Revised Form 941 for 1st

Quarter 2021

Updated on June 11, 2021 - 10:30 AM by Admin, ExpressEfile

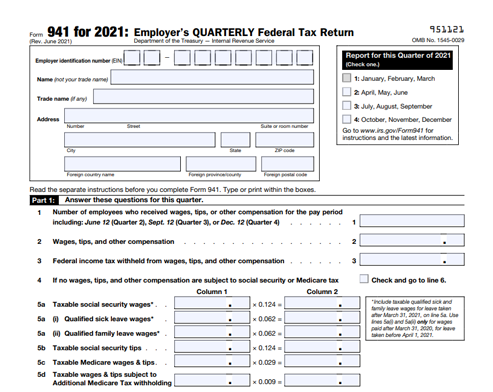

IRS Form 941 has seen multiple revisions in 2020 to report refundable employment tax credits, advance payment of employment tax credits, and deferral of employment taxes, which are announced by the federal government in order to overcome the COVID-19 pandemic. Now, the IRS has, once again, revised Form 941 and released a new Form 941 for

Quarter 1, 2021.

Employers are required to file the revised Form 941 from Quarter 1 for the 2021 tax year. Below are the topics covered in this article.

1. Form 941 Changes in 2020 - A Quick Recap

- The CARES Act allowed employers to defer the employer share of social security taxes. To accommodate the changes due to CARES Act, the

IRS revised Form 941 for Quarter 2, 2020. - Notice 2020-65 from the IRS provided an option for employers to elect to defer the employee share of social security taxes. To accommodate these changes, the IRS revised Form 941 for Quarters 3 and 4, 2020.

Earlier, it was mentioned that the employee share of deferred social security taxes should be paid on April 30, 2021. Based on Notice 2021-11, the deadline for paying the employee share of deferred social security taxes has been extended to December 31, 2021.

The IRS has revised Form 941 for Q2, 2021. The American Rescue Plan Act of 2021 (ARP), signed into law on March 11, 2021, includes relief for employers and their employees during COVID-19. As always employers need to report COVID-19 credits on Form 941, so the IRS has updated the form to reflect the ARP.

2. What are the Form 941 Changes for

Quarter 1, 2021?

Now that the social security tax deferment timeline has ended, employers will not be able to defer the employer or employee shares of social security taxes for the 2021 tax year. To accommodate this change, the IRS has revised Form 941 for Q1, 2021.

Here are the Form 941 changes for Q1, 2021:

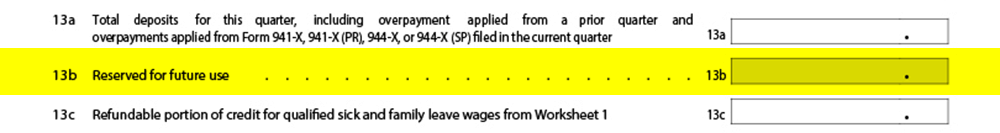

- Line 13b

- Line 13e

- Line 13g

- Line 24

Line 13b

| 2020 Q4 Form 941 | 2021 Q1 Form 941 |

|---|---|

|

Deferred amount of social security tax (This line was updated to report the total amount of deferred social security taxes, i.e., both employer and employer share.) |

Reserved for future use (As the payroll tax deferral is not applicable for Q1, 2021, this line is reserved for future use. There is no need to report anything in this line.) |

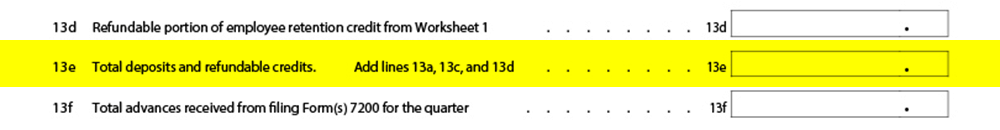

Line 13e

| 2020 Q4 Form 941 | 2021 Q1 Form 941 |

|---|---|

|

Total deposits, deferrals, and refundable credits.

(This line was used to report the total amount of tax deposits made in the quarter, total deferred social security taxes, refundable portion of qualified sick and family leave wages and employee retention credit.) |

Total deposits and refundable credits.

(This line will be used to report only the deposits made in the quarter and refundable credits, i.e., it excludes the tax deferrals as it is not applicable.) |

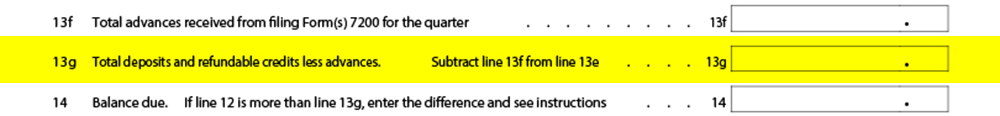

Line 13g

| 2020 Q4 Form 941 | 2021 Q1 Form 941 |

|---|---|

|

Total deposits, deferrals, and refundable credits less advances (This line was used to determine the total deposits, deferrals, and refundable credits without taking the advances received from filing Form 7200.) |

Total deposits and refundable credits less advances

(This line will now be used to determine total deposits made in the quarter and refundable credits excluding advances received through Form 7200, without tax deferrals.) |

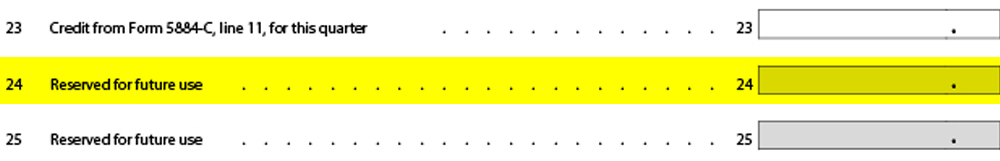

Line 24

| 2020 Q4 Form 941 | 2021 Q1 Form 941 |

|---|---|

|

Deferred amount of the employee share of social security tax included on line 13b (This line was used to report the employee share of deferred social security taxes, which is included in line 13b.) |

Reserved for future use

(As the payroll tax deferral is not applicable for Q1, 2021, this line is reserved for future use. There is no need to report anything in this line.) |

3. When is the deadline for filing Form 941

for 2021?

Employers need to file Form 941 every quarter, even if there are no taxes to report for a quarter. Below are the deadlines for filing Form 941 for the 2021 tax year. E-file Form 941 with ExpressEfile and get the filing status instantly.

| Quarter | Reporting Period | Due Date |

|---|---|---|

Quarter 1 |

Jan, Feb, and Mar |

April 30, 2021 |

Quarter 2 |

Apr, May, and Jun |

August 02, 2021 |

Quarter 3 |

Jul, Aug, and Sep |

November 01, 2021 |

Quarter 4 |

Oct, Nov, and Dec |

January 31, 2022 |

4. E-File Form 941 in less than 5 minutes with ExpressEfile

ExpressEfile supports the e-filing of the most up-to-date Form 941. The IRS also recommends that employers

file Form 941 electronically for quick processing. Also, the in-built audit-check in ExpressEfile validates your return and reduces the chances of IRS rejections.

Follow the simple steps below to

e-file Form 941 for Q1, 2021:

- 1. Enter the form information

- 2. Review the Form

- 3. Transmit it to the IRS

Filing takes less than 5 minutes