E-File Form 940 for

2023 Tax Year

- Quick & Secure Filing

- Instant Filing Status

- Error-free Filing

- Download/Email Forms

Benefits of Filing Form 940 Online With ExpressEfile

Below are the best benefits you’ll get when you E-file Form 940 through ExpressEfile

In-built Error Check

Get your form error-checked based on the IRS business rules and reduce the chances of

IRS rejection.

Instant Filing Status

Once the IRS processes your form, you will get instant filing status updates from us via email.

Complete Schedule A

Complete Schedule A and file it with the IRS if it is applicable to you. You won’t be charged any

additional amount.

E-Sign using Form 8453-EMP

Don’t have an online signature PIN? Complete and sign Form 8453-EMP to sign your

Form 940.

Start E-filing Form 940. It takes less than 5 minutes

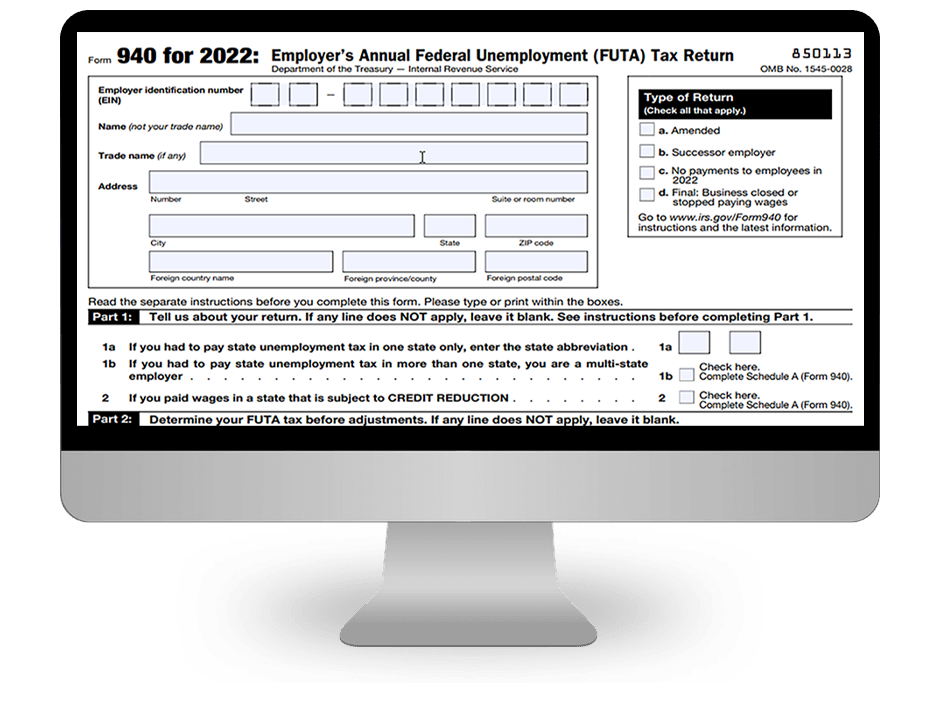

E-file Form 940 NowHow to File Form 940 Online for 2023?

Employers can file Form 940 online by following a few simple steps. It will take only a few minutes to complete the filing process.

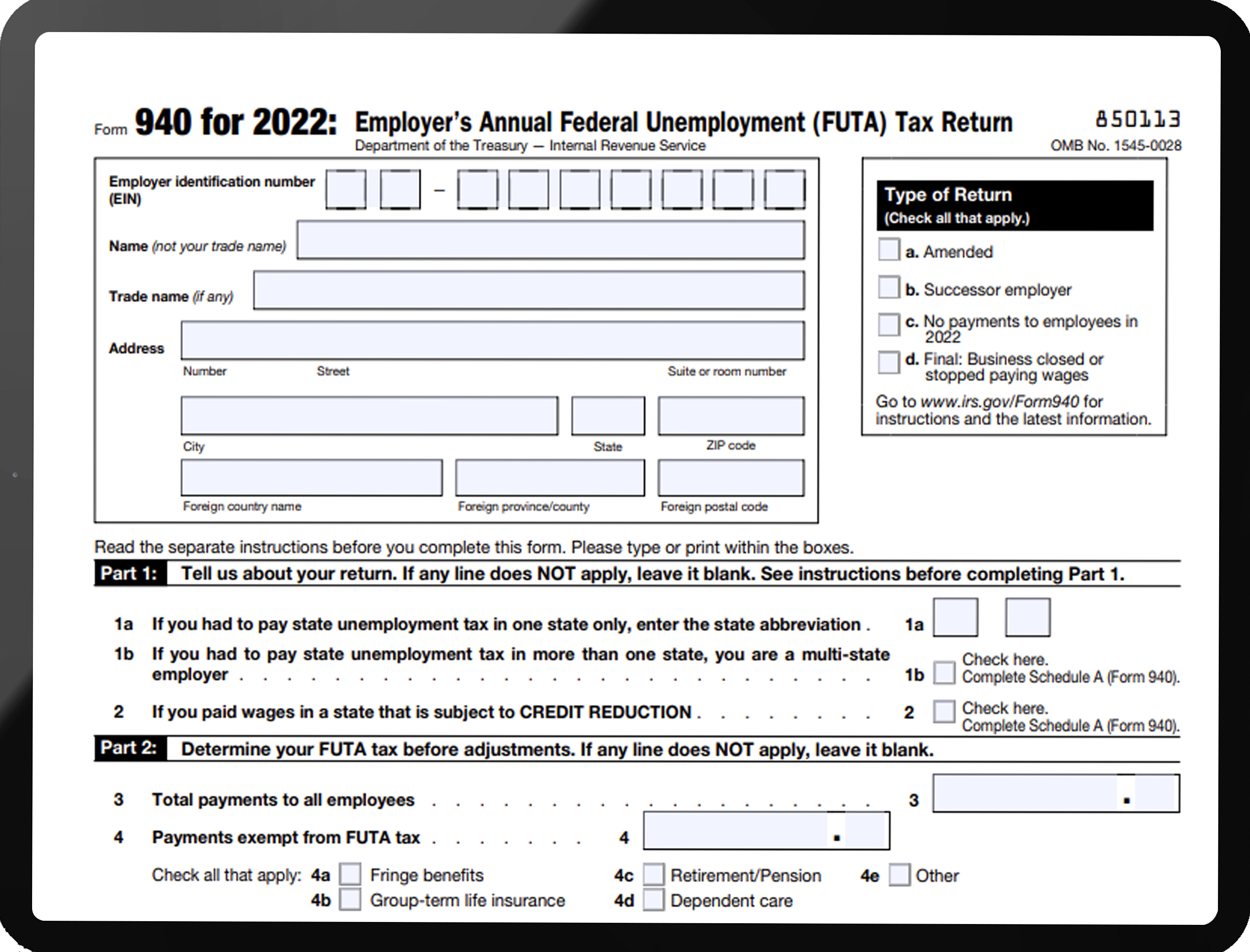

Enter Information

Enter total wages paid to all employees, Adjustments for state exclusions, and FUTA tax. Complete Schecule A

if applicable.

E-Sign Form 940

In order to complete

Form 940 online,

you must sign Form 940 using

Form 8453-EMP or 94x Online

Signature PIN.

Review & Transmit to IRS

The final step is to review your form before transmitting it to the IRS. Our built-in error check will make sure that the return is error-free.

Information Needed to E-File Form 940 for 2023?

Below is the information required to file your Form 940 online:

- Business Information: Name, EIN, and Address

- Total payments made to all employees

- Adjustments for state exclusions

(if applicable) - FUTA Tax

- Balance Due or Overpayment

- FUTA liability deposits

Have these details with you? Start filing Form 940 online and get the filing

status instantly.

E-file Form 940 Now

Customer Testimonials

E-file Form 940 with ExpressEfile and become one of

our satisfied customers

Frequently Asked Questions on Form 940

When is the Form 940 Due?

Form 940 is filed annually to report the FUTA tax paid during the tax year. Employers must file 940 on or before January 31st. If the deadline falls on a weekend or holiday, it can be filed the next business day. For the 2023 tax year, the deadline to file Form 940 is January 31, 2024. E-File Form 940 Now With ExpressEfile and get filing status instantly. E-File Now

What is the penalty for not filing Form 940 on time?

Employers who fail to file their 940 Form before the deadline are subject to penalty. The penalty for late filing Form 940 is 5% of the tax due. This amount continues to accrue on a monthly basis until it is paid back in full. The IRS also penalizes employers for late or partial payments. Employers can be charged from 2-15% of their unpaid tax.

How long does it take for the IRS to accept my 940 return?

Your Form 940 will be processed by the IRS within 30 minutes, which may differ based on your return volume. You will be notified by email once your return is processed by the IRS. Also, make sure you pay the tax due amount on time if you’ve chosen payment methods other than Electronic Funds Withdrawal (EFW).

How do I make my tax payment for Form 940?

You can pay the tax due amount to the IRS in multiple payment methods, such as Electronic Funds Withdrawal (EFW), Electronic Federal Tax Payment System (EFTPS), Credit or debit cards, and check or money order. Note that if you choose a payment method other than EFW, you are responsible to initiate and make payment

before

the deadline.