E-File Form 1095-B

Online for 2024

- Fast and Secure Filing

- Supports IRS and State Filing

- Bulk Upload Templates

- Supports Prior Year Filing

- Employee Copy Distribution

Pricing starts as low as $1.99/form

Benefits of Filing Form 1095-C Online With TaxBandits

Supports IRS &

State Filing

Effortlessly e-file your Form 1095-C and transmit to both Federal and State.

Postal Mailing

Save time and hassle by opting for our postal mailing services to distribute your recipient copies.

Online Access

Grant your recipient access and download the recipient copies of 1095-C form by choosing the online access service.

Bulk Upload Templates

Simplify the process and File multiple Form 1095-C using our bulk upload templates.

Simplify your 1095-C filing Process with Time-saving Features.

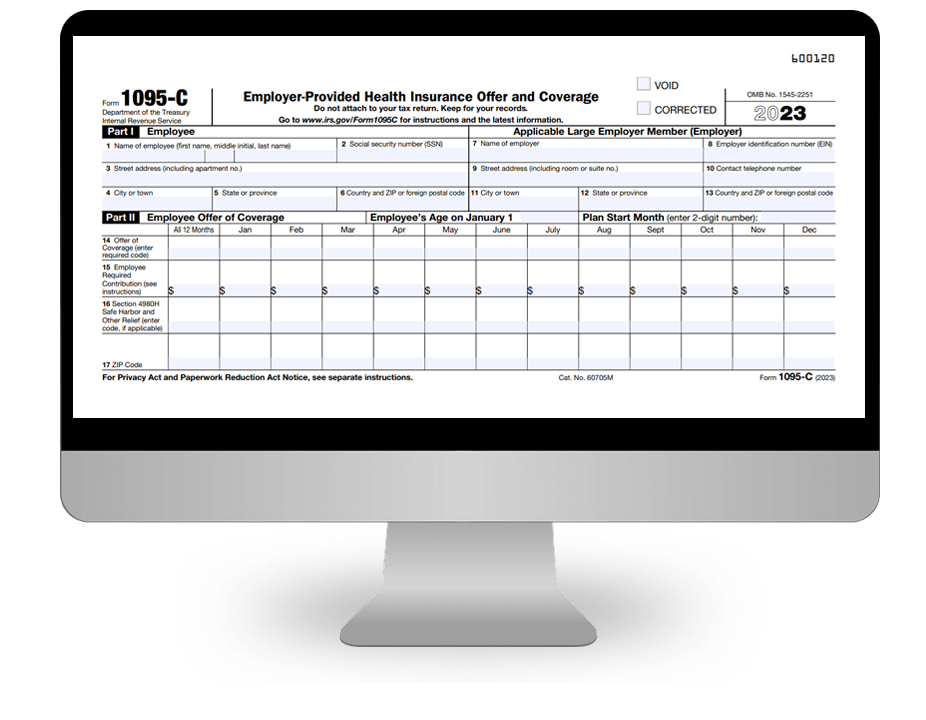

Enter Information

Enter the information such as employer and employee details, employees offer of coverage details.

Review Form

Review the entered information and update the information in case you find any mistakes.

Transmit the Return to IRS

Simply transmit the return to the IRS and state, if any. You can download a copy of the return once the IRS accepts the Form.

Information Needed to E-File Form 1095-C

- Employer Details: Name, EIN, and Address

- Employee Details: Name, SSN, and Address

- Employee Offer of Coverage details: ACA Codes, and amounts

- Covered Individual Details: Name, TIN, Date of Birth (if SSN or other TIN is not available), covered months

Frequently Asked Questions:

What is Form 1095-C?

The IRS Form 1095-C is used to report the information about the employee health cover offered by an Applicable large employee (typically a business that has 50 or more full-time employees) during the calendar year. IRS uses the information in Form 1095-C to determine the taxpayer's eligibility for premium tax credits.

When is the deadline to file 1095-B/1095-C?

The due date to distribute recipient copies is March 3, 2025, and the deadline to file Form 1095-C with the IRS is February 28, 2025, and the e-filing deadline is on March 31, 2025.

Are there any penalties for late filing ACA Forms 1095-B/1095-C?

Businesses are subject to IRS aca penalties for the following reason

- Missing the filing deadline

- Failing to provide correct information,

- Filing paper forms when the electronic filing was required.

In case the business fails to file before the deadline or provides incorrect information, the business incurs a penalty of $330 for each return and to a maximum of $3,987,000.

How to extend the Form 1095-C Deadline?

If you are unable to file Form 1095-C before the deadline and need additional time. You can apply for a 30 days extension period by filing Form 8809 before the original deadline.

What are the State Filing Requirements of Form 1095-C?

The following state mandates the filing of Form 1095-C

It should be noted that for all these states except Massachusetts, the federal copy of 1095-C Form can be submitted to comply with the state requirements. However, Massachusetts has an additional requirement, and applicable entities must file Form MA 1099-HC.

Ready to File Form 1095-C Online for the 2024 Tax Year?

E-File your Form 1095-C in minutes and postal mail recipient copies.

Pricing starts as low as $1.99/form