E-File Form 1099-NEC

for 2024 Tax Year

- Quick & Secure Online Filing

- In-built Error check

- Get Filing Status Instantly

- Postal Mail Recipient Copies

- Supports Bulk Filing

Benefits of Filing Form 1099-NEC Online With ExpressEfile

Below are the best benefits you’ll get when you E-file Form 1099 through ExpressEfile

Instant Filing Status

You will receive instant notifications via email as soon as the IRS processes your return.

In-built Error Check

Your returns will be validated based on IRS business rules in order to reduce the chances of rejection.

Postal Mailing

Opt for the postal mailing option to send return copies to your recipients on your behalf.

Email Form Copies

After transmitting the return to the IRS, you can download the copies or email them directly to the recipients.

How to File Form 1099-NEC Online for 2024 Tax Year?

Follow the simple steps below to File 1099 NEC online.

Enter Information

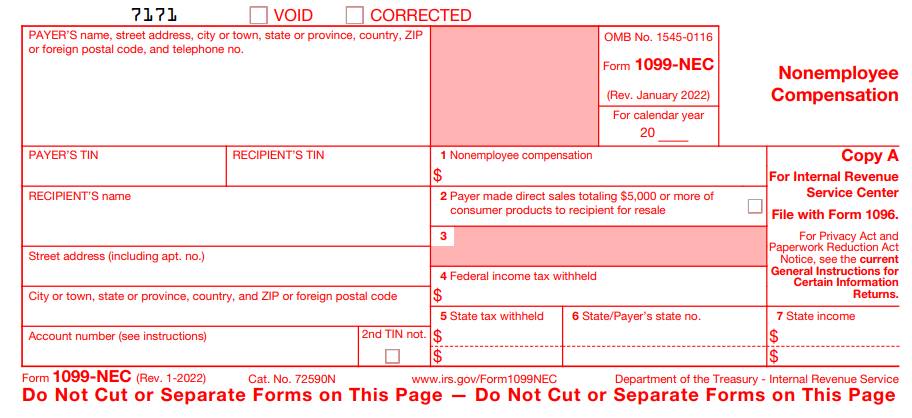

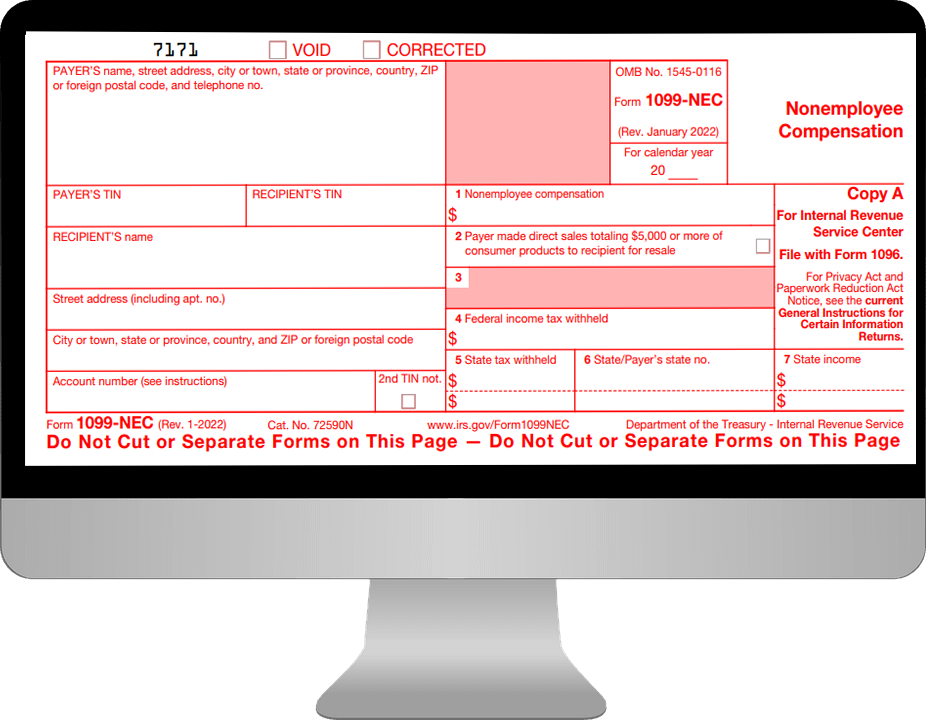

Enter the 1099 form 2024 information such as payer and recipient info, nonemployee compensation, and federal income tax withheld if any.

Review Form

Review the draft form and make sure the information entered is correct. Update the information if you find

any mistakes.

Transmit the Return

to IRS

If there are no mistakes, simply transmit the return to the IRS. You can then download or email the return copies from the application.

Start E-filing Form 1099-NEC. It takes less than 5 minutes.

Get your Fillable W-9 Form Online

The fillable W-9 solution offered by TaxBandits enables users to easily fill and e-sign the W-9 form in minutes. Our system performs basic data validations to make sure the W-9s are accurate and error-free. Once completed, the W-9s are securely stored and can be accessed, edited, or shared at any time.

Information Needed to E-File Form 1099-NEC

Here are the details required to file Form 1099 NEC online:

- Payer Details: Name, TIN, and Address

- Recipient Details: Name, SSN/EIN, and Address

- Nonemployee compensation

- Federal income tax withheld

- State Filing Details:

State Income, Payer State Number, and State Tax Withheld

If you have the above information ready, start filing Form 1099-NEC online.

It takes less than 5 minutes.

Customer Testimonials

Make the smart choice of e-filing with ExpressEfile

Frequently Asked Questions on Form 1099-NEC

What is IRS Form 1099-NEC?

Form 1099-NEC is filed to report payments ($600 or more) made to nonemployees or independent contractors for the work done. Earlier, nonemployee compensation was reported in Box 7 of Form 1099-MISC. Now, the IRS wants it to be reported in a separate 1099 form.

Here are the things to be reported in the 1099-NEC Form.

- Fees

- Commissions

- Prizes

- Awards

- Other forms of compensation for service

When is the deadline to file Form 1099-NEC?

The 1099 due date 2024 to send recipient copies is January 31, 2025. Also, the deadline to file 1099-NEC (both paper and electronic filing) with the IRS is January 31, 2025.

E-File Form 1099 with ExpressEfile to meet your deadline. E-File Now

What is the penalty for not filing 1099-NEC on time?

The IRS will impose penalties if you fail to file Form 1099-NEC on time. Below are the penalties of IRS Form 1099-NEC:

If you file Form 1099-NEC within 30 days after the deadline, there will be a penalty of $60/return.The penalty rate will continue to increase $130/return if you file after 30 days but before August 1, and to $330/return if you file after August 1.

The best way to avoid penalties is to E-File Form 1099 NEC easily with ExpressEfile and get the filing status instantly.

How long does it take for the IRS to accept my Form 1099-NEC?

The IRS will process Form 1099-NEC within 1-2 business days. When you e-file Form 1099-NEC through ExpressEfile, you will receive the status of your return by email instantly as soon as the IRS processes your return.

Are there any exemptions for filing Form 1099-NEC?

Yes, you are not required to file Form 1099-NEC if you have paid:

- C or S corporation,

- For the merchandise, telegrams, telephone, freight, storage, and similar items, or

- Tax-exempt organizations.

I have information for multiple payees. How do I enter all of them in order to complete my 1099 forms?

ExpressEfile easily handles this: simply use one of our two upload options, Smart Upload or Bulk Upload.

- Smart Upload: Use your own 1099 Excel template to upload all of your data.

- Bulk Upload: Use our Excel sheet to input and upload your data all at once.

Click here to learn more about our bulk filing feature.

When Are You Required to Issue a 1099?

IRS regulations require you to issue most 1099 forms by January 31st. It's essential to understand the circumstances that necessitate issuing a 1099 form for accurate income reporting. Here are some typical situations that require issuing 1099 Forms:

- Form 1099-NEC - You need to issue this form if you paid $600 or more in nonemployee compensation to independent contractors,

self employed individuals or freelancers. - Form 1099-MISC - This form should be issued for payments exceeding $600 for rents, other income payments, medical and health care payments, payments to an attorney, crop insurance proceeds, cash paid from a notional principal contract to an individual, partnership, or estate, fishing boat proceeds, section 409A deferrals, nonqualified deferred compensation, and other payments.

- Form 1099-INT - You must issue this form for payments of $10 or more in interest income earned on savings accounts, certificates of deposit (CDs), and other investments.

Helpful Resources for Filing Form 1099-NEC

Ready to E-File Form 1099-NEC for 2024 Tax Year?

E-File your 1099-NEC in minutes and postal mail recipient copies.

Pricing starts as low as $0.80/form