How To Download or E-file Form 2290 to the IRS Using ExpressEFile?

Step 1

Select “Form 2290” & Enter Business Details

Enter Schedule 1 information to generate your Form 2290.

- Select “Form 2290” from the list of our supported forms.

- Enter EIN, name associated with EIN, address and first used month of the vehicles reported.

- Complete “Part 1” by entering the VIN & choosing the weight category of each vehicle.

Note: For your convenience, lines in “Part 2” will be calculated automatically based on the information provided in “Part 1.”

Click “Save and Continue.”

Step 2

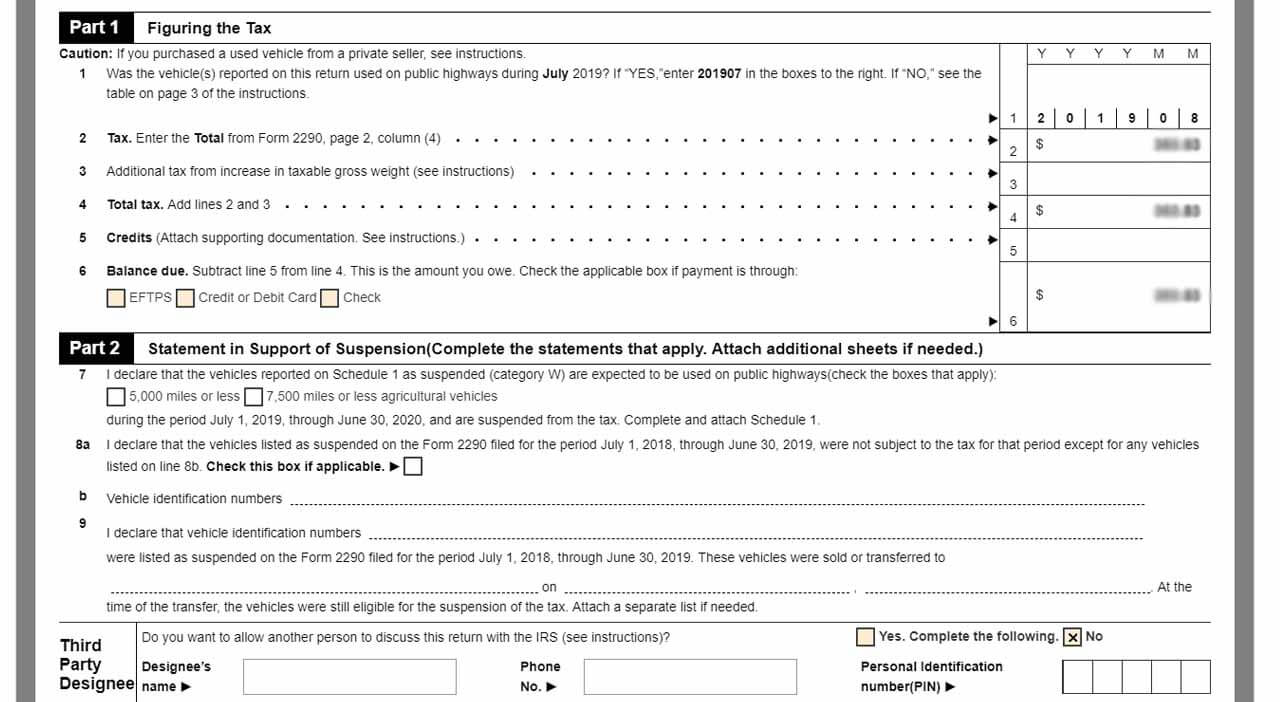

Review & Complete Form 2290

Lines under Form 2290 will be auto-generated based on information provided on Schedule 1.

- The information for “Part 1” and “Part 2” will be generated automatically and will include the tax amount that you owe.

- Check the appropriate box following “Line 6” to indicate that you are making the IRS payment via EFTPS or Credit/Debit Card.

Click “Update and Continue”

Step 3

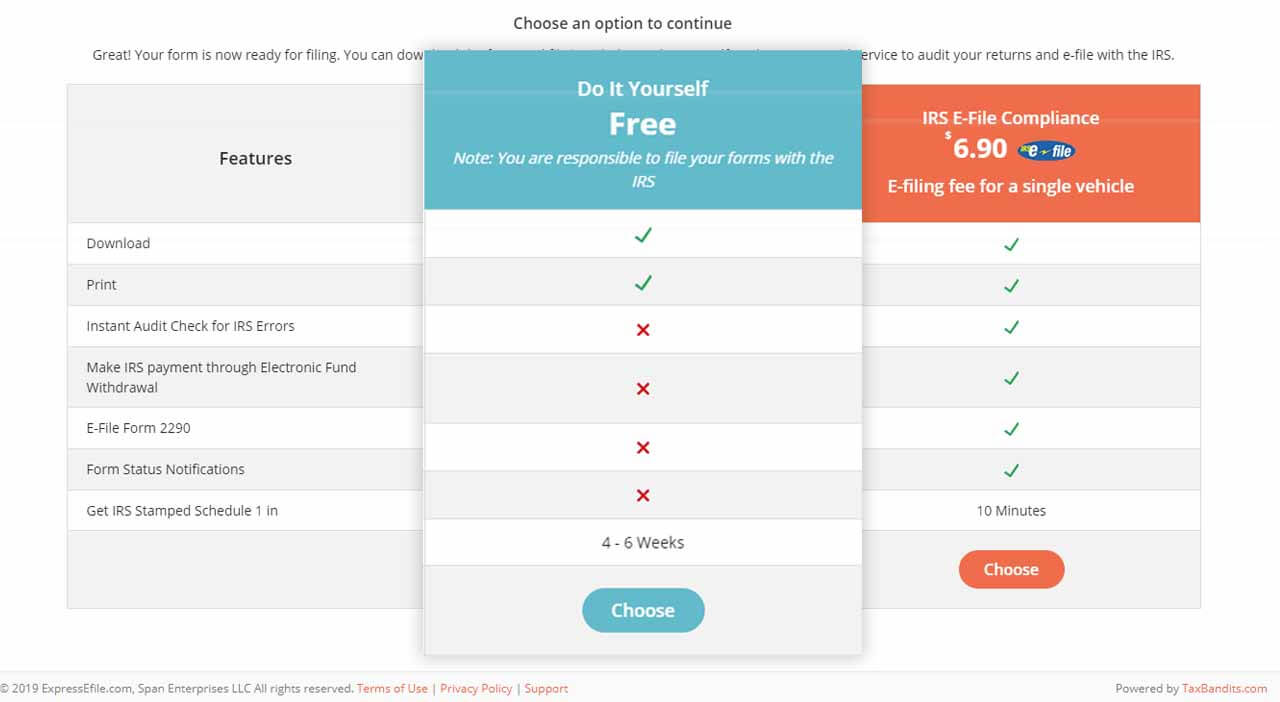

Download & Print Forms for Free!

- Download your Form 2290.

- Choose the “Do It Yourself” option to download your Form for free.

- Select “Form 2290” to download the Form to your desktop, laptop or mobile device.

- Print, sign, and mail your Form to the IRS.

Note: You are responsible for sending Form 2290 to the IRS if you choose the “Do it Yourself” option.

Step 4

E-file Your Form 2290

Choose “IRS E-File Compliance” to e-file Form 2290 directly with the IRS.

- Choose “IRS E-File” to e-file your Form 2290 directly to the IRS.

- Select your preferred IRS payment method and click “Next.”

- Provide your “Business Type” and “Signatory” details to e-file your return and click “Next.”

- Your form will be processed to ensure it is error-free. If errors are found, simply click “Fix Me” or click “Next” if no errors are found.

Step 5

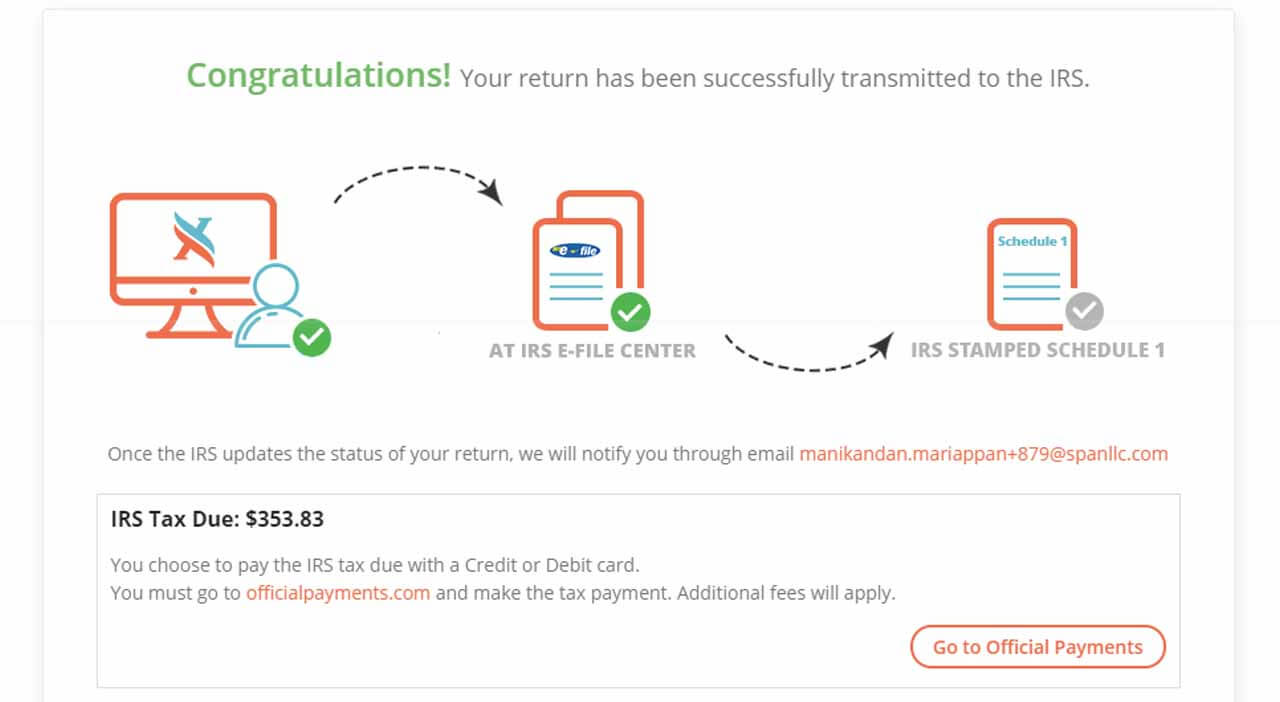

Transmit Your Form 2290 to IRS

- Review a summary of your Form and edit information, if needed.

- Enter a 5-digit PIN of your choice to transmit your return and click “Transmit the return to the IRS*.”

- ExpressEfile will then transmit your return to the IRS and notify you about the filing status via email.

- The status of your filing can be checked right from your ExpressEfile account.

Once your Form 2290 is accepted, you will receive an email with your Schedule 1 (Form 2290) and can request a printed copy using ExpressEfile.