Washington Form W-2 Filing Requirements

the state of Washington

Form W-2 Filing Requirements for the State of Washington

Updated on December 28, 2020 - 10:30 AM by Admin, ExpressEfile Team

The state of Washington does not have a state income tax, and therefore, you are not required to file Form W-2 with the state.

However, you are still required to file Form W-2 with the SSA to report employee wages and the taxes withheld from the employee during the

tax year.

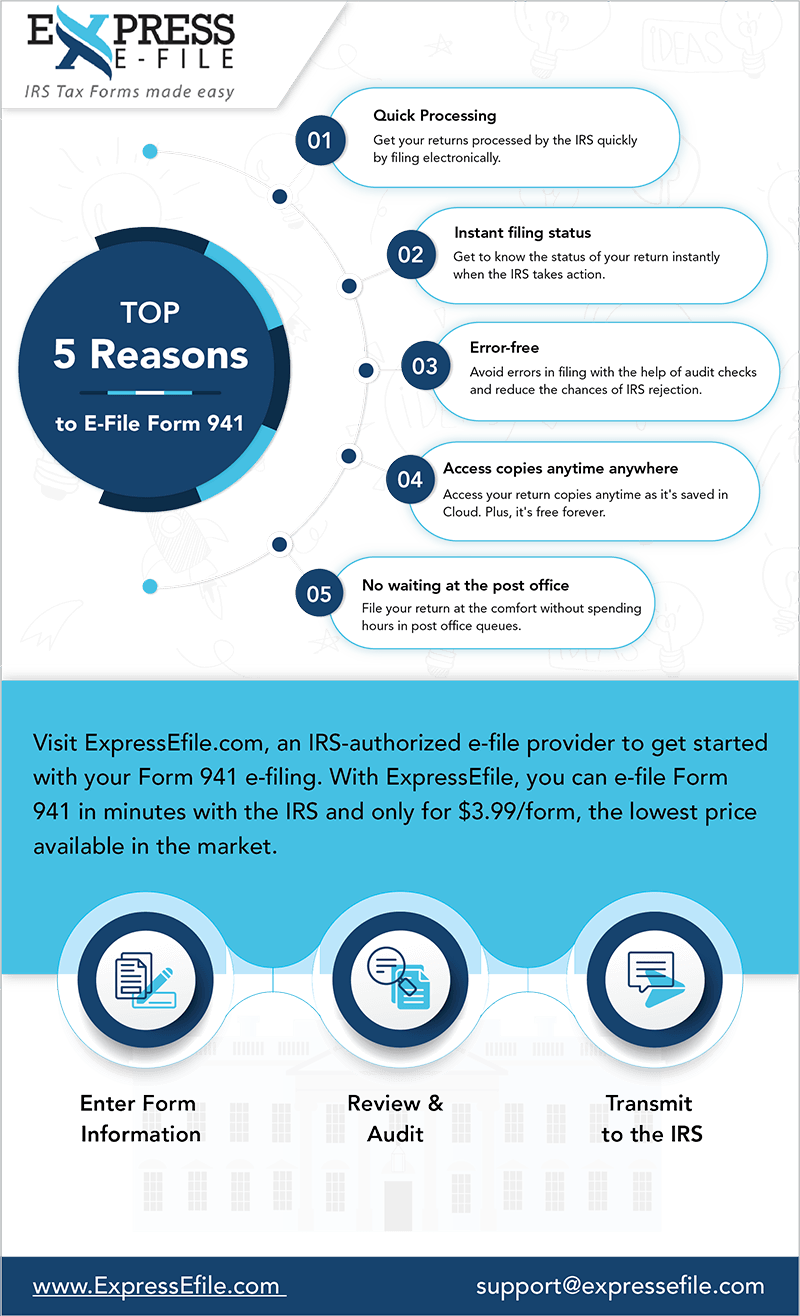

E-file Form W-2 with the SSA through ExpressEfile easily and securely for the lowest price ($1.49/form) in the industry. Also, you can mail your employee copies using our postal mailing option. It just costs $2.99/form to e-file the return and mail employee copies.

File with confidence