Form 941 First Quarter Deadline is April 30, 2022.

E-File Now

Form W-2 Mailing Address

This article covers the following topics:

- Mailing Address of Form W-2

- Advantages of E-filing over Paper filing

- Filing Form W-2 in less than 5 minutes

Mailing Address for Form W2

Updated on November 12, 2024 - 10:30 AM by Admin, ExpressEfile

Considering paper filing Form W-2 this tax season? It’s a big job and there is a lot to take into consideration. Find out everything that goes into the paper filing process, determine your IRS mailing address, and stay up to date on the latest IRS recommendations for your business.

1. Mailing Address For Form W-2

If you choose to paper file Form W-2 using US Postal Service, mail your returns to the Social Security Administration at:

Data Operations Center,

Wilkes-Barre,

PA 18769-0001.

If you choose to paper file Form W-2 using private delivery service, mail your returns to the Social Security Administration at:

Data Operations Center,

ATTN: W-2 Process,

1150 E. Mountain Drive,

Wilkes-Barre,

PA 18702-7997.

E-filing your Form W-2 return results in much quicker processing by the SSA. Meet your deadline, avoid penalties, and increase your chances of SSA approval.

File Form W-2 Now

2. Form W-2 filing Deadline

Form W-2 is used to report all the wages paid to employees and the taxes withheld from employee paychecks for the tax year. This form is filed with the Social Security Administration (SSA). Form W2 copies are also provided to employees to be used for their income tax returns.

Below is the dead file Form W-2 with the SSA and mail recipient copies:

| Description | Deadline |

|---|---|

File with the SSA |

January 31, 2025 |

Send Employee Copies |

January 31, 2025 |

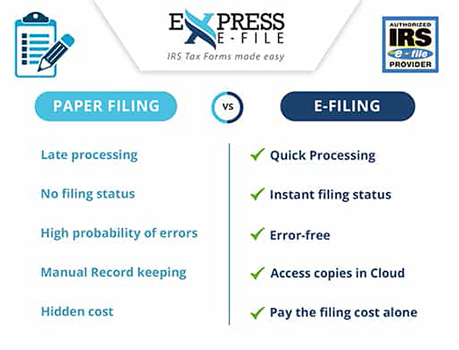

3. Advantages of E-filing over Paper filing

E-filing is the best option for meeting tax requirements and it is especially important for Form W-2. When employers file Form W-2, they not only need to provide their information to the SSA and the state, but also, they have to send a copy to every single one of their employees.

Sending out Form W-2 copies introduces the added variable of mailing lags, more opportunities for penalties, and additional paperwork for your business. When you e-file Form W-2 with ExpressEfile, we eliminate the hassle and manage and mail all your copies on time.

With ExpressEfile, you also get access to internal error checks. If you make a mistake on Form W-2, it is difficult to correct it on a paper copy. When you file Form W-2 online, our software checks all your information for errors and discrepancies and makes it easy to fix errors before you transmit your return.

After you e-file Form W-2 online, we automatically generate a free Form W-3 for your records.

Check out the infographics below to know the advantages of e-filing over paper filing.

4. Filing Form W-2 in less than 5 minutes

With ExpressEfile, you can e-file Form W-2 for as low as $1.49 /form (very less compared to paper filing). Our in-built audit check ensures error-free filing and you'll also get filing status instantly. ExpressEfile lets you choose to opt for postal mailing of recipient.

- 1. Enter your Information Easily

- 2. Review the Form

- 3. Transmit Form W-2 directly to the SSA

It’ll take only a few minutes