Form 941 First Quarter Deadline is April 30, 2021.

E-File Now

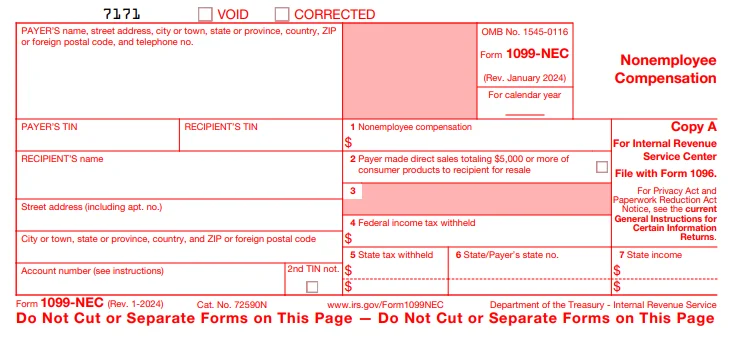

Form 1099-NEC - Nonemployee Compensation

Get to know about the Form 1099-NEC

IRS Form 1099-NEC - Overview

Updated on November 08, 2024 - 1:30 AM by Admin, ExpressEfile Team

The IRS introduced Form 1099-NEC again, after 1982, in order to avoid confusion in deadlines for filing Form 1099-MISC. Form 1099-NEC must be filed to report nonemployee compensation paid in a year, which has been reported in Box 7 of 1099-MISC.

Read on to learn more about the 1099-NEC Form. The following are the topics covered in this article:

1. What is Form 1099-NEC?

IRS Form 1099-NEC is filed by payers who have paid $600 or more as nonemployee compensation for an independent contractor or vendor (i.e., nonemployee) in a calendar year. The form must be filed with the IRS and also a copy of the return must be furnished to the recipient.

2. Who must file Form 1099-NEC?

Businesses that made payments to at least one independent contractor or vendor as nonemployee compensation in a year must file Form 1099-NEC.

Nonemployee compensation—Explained!

As per the IRS, a payment is considered a nonemployee compensation if one of the following conditions met:

- The payer has made payment to someone who is not their employee or an individual, partnership, estate, or corporation

- The payer has made payment for services in the course of business or trade

- The payer has made payment totaling at $600 in the calendar year

Note: If you have withheld federal income tax based on backup withholding from a nonemployee, you must file 1099-NEC for them, even if you haven’t paid $600 in a year.

The nonemployee compensation may include the following payments:

- Fees

- Benefits

- Commissions (including payments made to nonemployee salespeople)

- Prizes and awards for the services rendered by a nonemployee

- Fish purchases for cash

- Professional service fees paid to attorneys

- Any other form of compensation for services performed for your trade or business by a nonemployee.

Form 1099 must be filed only if you are a payer in a business or trade for profit. DO NOT file Form 1099-NEC to report personal payments.

3. When is the deadline to file Form 1099-NEC?

The IRS has set a deadline for both filing Form 1099-NEC and issuing copies of the form to recipients.

Below is the deadline for Form 1099-NEC:

| File Form 1099-NEC by paper on or before | File Form 1099-NEC electronically on or before | Send recipient copies of Form 1099-NEC on or before |

|---|---|---|

January 31, 2025 |

January 31, 2025 E-File Now |

January 31, 2025 |

4. Information required to file Form 1099-NEC

Form 1099-NEC is a simple form, and there are only a few details that are required to file the form. Below are the details required to file Form 1099-NEC:

- Payer's Information - Name, EIN, and Address

- Recipient's information - Name, EIN/SSN, and Address

- Nonemployee compensation amount - Amount paid in the calendar year

- Federal income tax withheld - Income tax withheld based on backup withholding rules

- State information - State Income, Payer State Number, and State Tax Withheld

5. What are the copies of Form 1099-NEC?

Form 1099-NEC consists of 5 copies with each have its own purpose. Below are the copies:

- Copy A - Sent to the IRS (Internal Revenue Service)

- Copy 1 - Sent to the State tax department

- Copy B - For the recipient

- Copy 2 - For the recipient to file with his/her state income tax return

- Copy C - For Payer to keep for your own business records

Use the postal mailing option while you e-file Form 1099-NEC through ExpressEfile, and we’ll send your recipient copies on your behalf before the deadline.

6. Penalty for filing Form 1099-NEC late

The IRS will impose a penalty for late filing of Form 1099-NEC, and the penalty rates vary based on how late you file the return. Below are the penalty rates based on the filing date of the form:

| If you file Form 1099-NEC after the deadline | Within 30 days | More than 30 days, but before August 1 | After August 1 |

|---|---|---|---|

$60 per information return |

$130 per information return |

$330 per information return |

For small businesses with an average annual gross receipt for the 3 most recent tax years of $5 million or less, there will be lower maximum penalties.

7. File Form 1099-NEC using ExpressEfile

As it is a new 1099 form, it is recommended that you e-file Form 1099-NEC in order to avoid errors and delays in filing. With ExpressEfile’s built-in audit check, you can clear almost all of the errors in your return, so the chances of rejection are rare. Also, the filing cost is very less compared to paper filing.