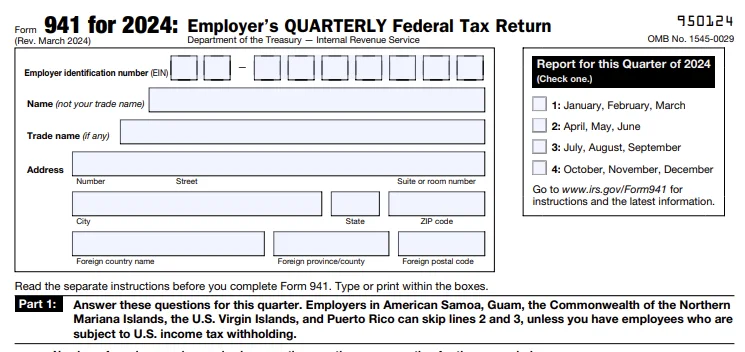

Form 941: Employer’s Quarterly Federal

Tax Return

Last Updated:

June 11, 2025

IRS Form 941: An Overview

Form 941 is the form your business uses to report federal income taxes, social security, and medicare taxes withheld from your employee's paychecks. Generally, if your business pays wages to an employee you are required to file a Form 941 every quarter.

Employers must continue to file Form 941 quarterly even if there are no employees during some quarters.

The following are the topics covered in this article:

1. What is Form 941?

IRS Form 941, Employer’s Quarterly Federal Tax Return, is used by businesses to report information about taxes withheld such as federal income, FICA taxes, and additional medicare tax withheld from the employee wages with the equivalent employer contribution.

Along with filing your 941 tax Form with the IRS, you can also required to make a quarterly tax payment.

File your 2025 Form 941 accurately as the IRS compares the amounts on your Form 941 with your annual Form W-3, Transmittal of Wage and Tax Statements.

2. Changes in Form 941 for the 2025 tax year?

The IRS has revised Form 941 for the 2025 tax year. Here are some major changes mentioned below:

- The Social Security wage base limit has been increased for 2025.

- Payroll tax withholding thresholds are updated for household and election workers.

- The IRS now provides an option to e-file Form 941-X to make corrections to previously filed Form 941.

Visit https://blog.taxbandits.com/the-irs-released-form-941-for-2025-key-changes-and-updates-released-by-the-irs/ for more detailed information about the changes in Form 941 for 2025.

3. Final Checklist Before Filing Form 941

When it comes to Form 941 filing, employers can file Form 941 online or by mail, although the IRS recommends e-filing. Electronic filing is often quicker and more convenient, with the benefit of immediate acknowledgment of your return.

To make the filing process easier, you must have the payroll records and business information beforehand. You'll need:

- Your basic business information (name, address, EIN)

- Your total employee count

- Federal income tax withheld

- Medicare and Social Security withholding information

- Tax Deposits made to the IRS

- Your tax liability for the quarter ended

Visit https://expressefile.com/form-941-instructions to get step-by-step instructions to fill out Form 941.

4. Who is exempt from filing Form 941?

The following are a few exceptions to the Form 941 filing:

- Seasonal employers need to file 941 for the quarters in which they are operating.

- Businesses that hire farm workers or household employees, such as maids aren’t required to file Form 941.

- And if your business pays less than $1,000 in employment tax in a given tax year then you are not required to file Form 941.

5. Form 941 2025 Deadlines

As an employer, you must file Form 941 every quarter, even if you have no taxes to report unless you fall into any one of the exceptions above.

The 941 due dates typically fall on the last day of the month following the end of the quarter.

First Quarter

( January, February, March)

Second Quarter

(April, May, June)

Third Quarter

( July, August, September)

Fourth Quarter

(October, November, December)

Visit https://expressefile.com/form-941-due-date to know the due dates to deposit the taxes withheld.

6. Determining Your Deposit Schedule

The IRS determines your business’ deposit schedule based on your tax liability. This will determine whether you are a monthly or semiweekly depositor. Here are the general rules when it comes to the IRS deposit schedule.

- If your business has tax liability totaling less than $50,000, then the IRS considers you a monthly depositor.

- If your business has tax liability totaling more than $50,000, the IRS considers you a semiweekly depositor.

- Semi-weekly depositors are required to fill out 941 Schedule B and attach it to Form 941.

Visit https://www.expressefile.com/form-941-schedule-b/ to learn more about Form 941 Schedule B.

7. What Are The Penalties Associated with Form 941?

The penalties for Form 941 may seem minor compared to other forms, but they will end up with a huge penalty if the payments or filing is not done on time.

The IRS will impose a penalty for failure to file 941 on time and similarly, there will be failure to deposit penalty if you fail to deposit taxes withheld on time and in full to the IRS.

Visit https://expressefile.com/form-941-penalty to learn more about Form 941 late filing and late payment penalties.

8. How to simplify your Form 941 tax filing?

The easiest way to simplify your Form 941 filing is by using TaxBandits, our trusted partner and an IRS-authorized e-file provider helping businesses like yours to get their Form 941 filing done right on time with automated and time-saving features.

Click here to learn how TaxBandits simplifies your 941 tax filing.