E-file 1099, W-2, 94x, and 1095 Forms Securely And Quickly

Get the lowest price in the industry.

Save 10% Instantly with the New Form 941 Bundle!

File smarter and save more—get 10% OFF instantly with our 941 Filing Bundle!

- Save 10% Instantly: Buy your bundle today and enjoy an immediate 10% discount.

- One-Time Payment, Year-Round Filing: Skip the hassle of paying every quarter—just pay once and you’re covered.

- Valid Until You File Everything: Use the bundle at your pace—forms remain available until they’re all submitted.

Bundle 1:

Includes 4 Form 941s & 1 Form 940

$29.75 $26.775

Bundle 2:

Includes 4 Form 941s

$23.8 $21.42

Simplify your filing, save more, and stay compliant

Select the form you need and e-file with the IRS/SSA

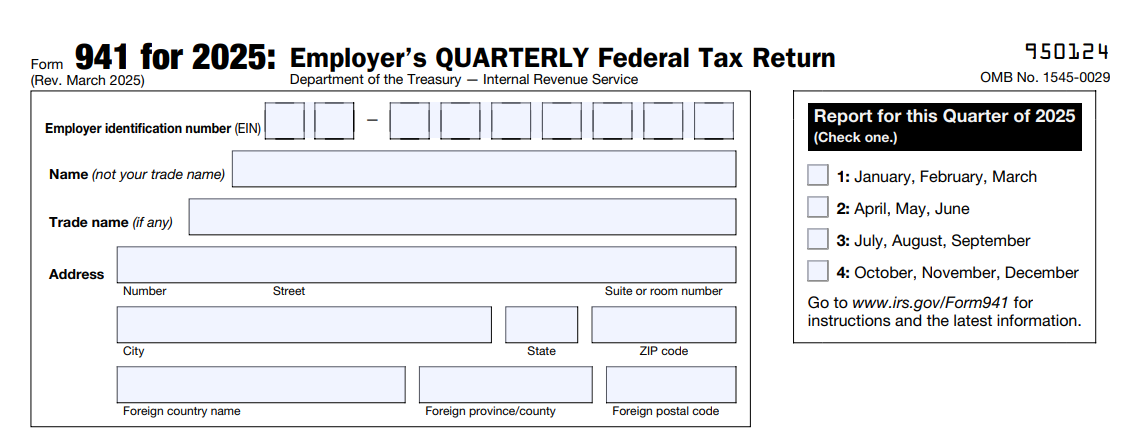

Form 941 - Employer's Quarterly Federal

Tax Return

Employers file Form 941 every quarter to report withholdings from employee paychecks for federal income taxes, Social Security, and Medicare (FICA).

Get quick processing and instant notifications on IRS approval when you e-file Form 941. It only takes a few minutes.

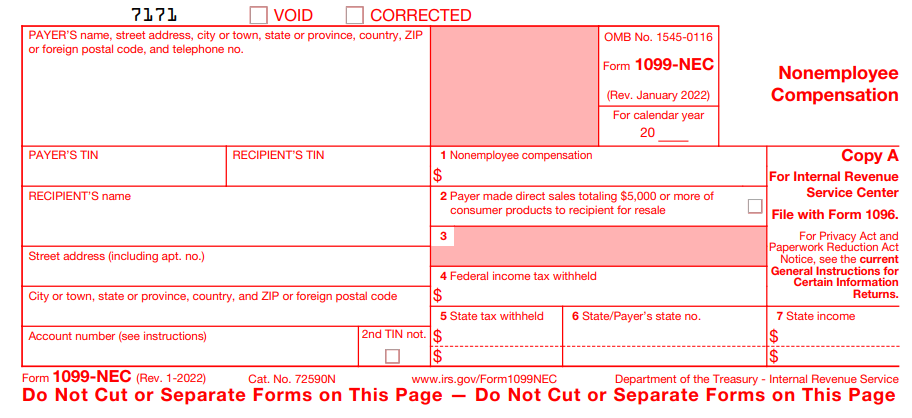

Form 1099 - NEC - Nonemployee compensation

Form 1099-NEC is filed to report payments ($600 or more) made to or nonemployees for the work done. Earlier, nonemployee compensation was reported in Box 7 of Form 1099-MISC. Now, the IRS wants it to be reported in a separate 1099 tax form.

E-File Form 1099-NEC in minutes and get the filing status instantly from the IRS.

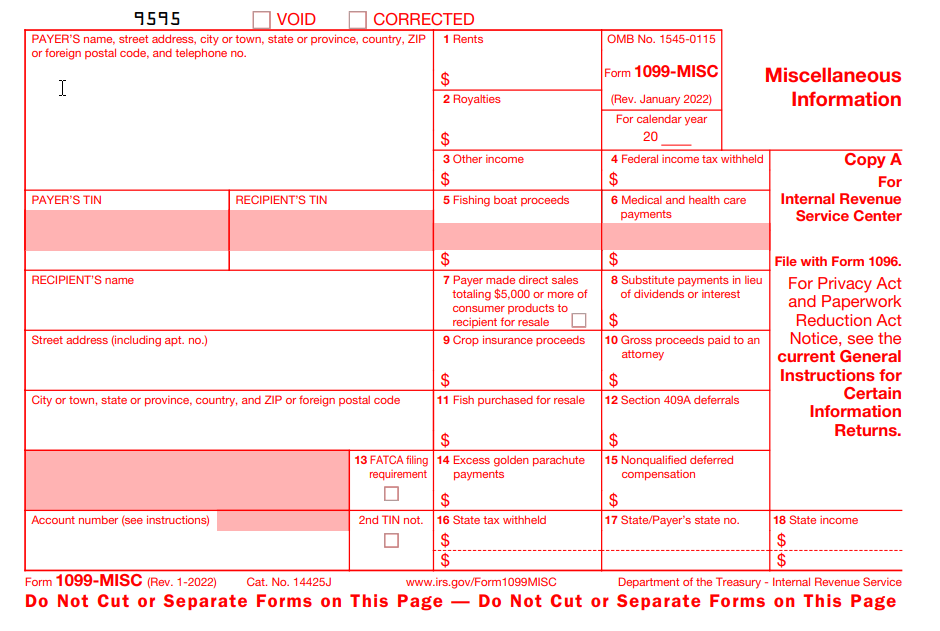

Form 1099 MISC - Miscellaneous Income

Form 1099-MISC is a yearly 1099 online tax form that reports miscellaneous payments made to non-employees and independent contractors. These payments include rental payments, fishing boat proceeds, prizes, rewards, or substitute payments in lieu

of dividends.

E-File Form 1099-MISC in minutes and get the filing status instantly from the IRS.

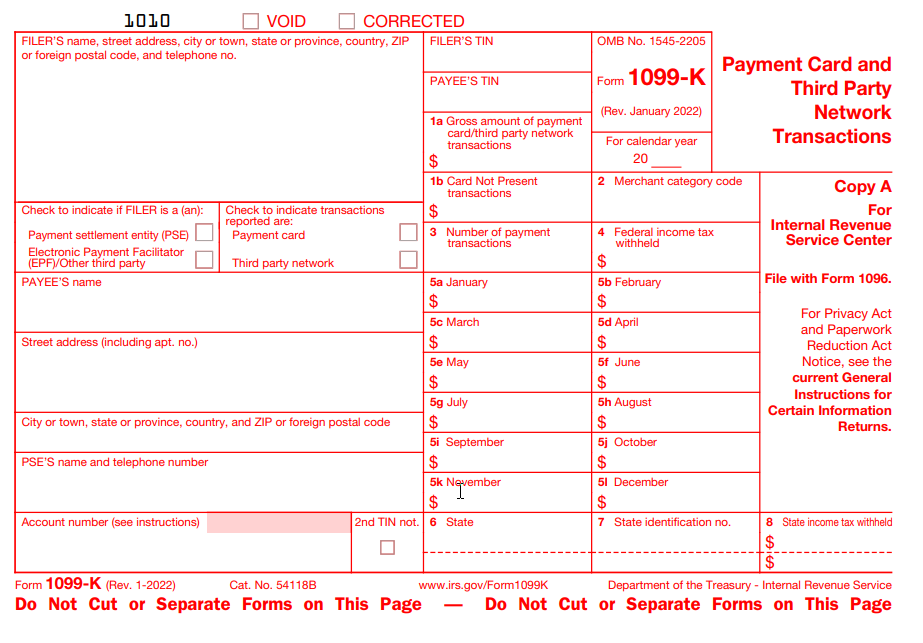

Form 1099 K - Payment Card and Third-Party Network Transactions

Form 1099 K is an IRS information return statement used by the Payment Settlement Entities to report the reportable gross payment made through payment cards and third-party network transactions of at least $600 during the calendar year.

IRS has released new changes in the 1099-K threshold and transaction limits for the 2023 tax year. When the gross payment made through third-party networks (payment apps and online marketplace) exceeds $600 will receive Form 1099-K from PSE regardless of the number of transactions made.

File 1099 K online at the lowest price of $0.80/form with TaxBandits. It only takes a few minutes to e-file

with us.

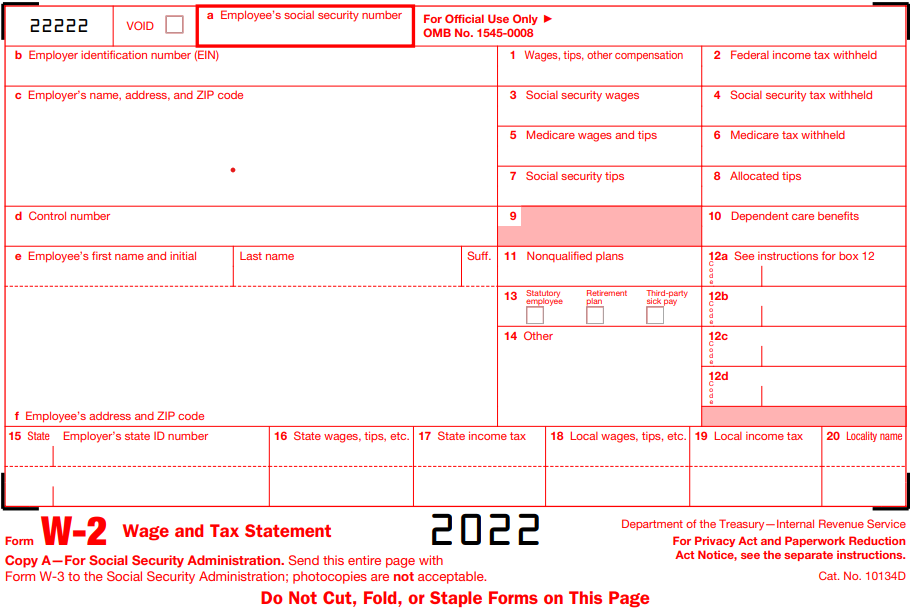

Form W-2 - Wage and Tax Statement

Employers file Form W-2 every year to report employee wages and the amounts withheld from employee paychecks for Social Security, Medicare, and Additional Medicare taxes. Employers submit Form W2 to the Social Security Administration (SSA) and send copies to their employees.

E-File Form W-2 in minutes and get the filing status instantly from the SSA.

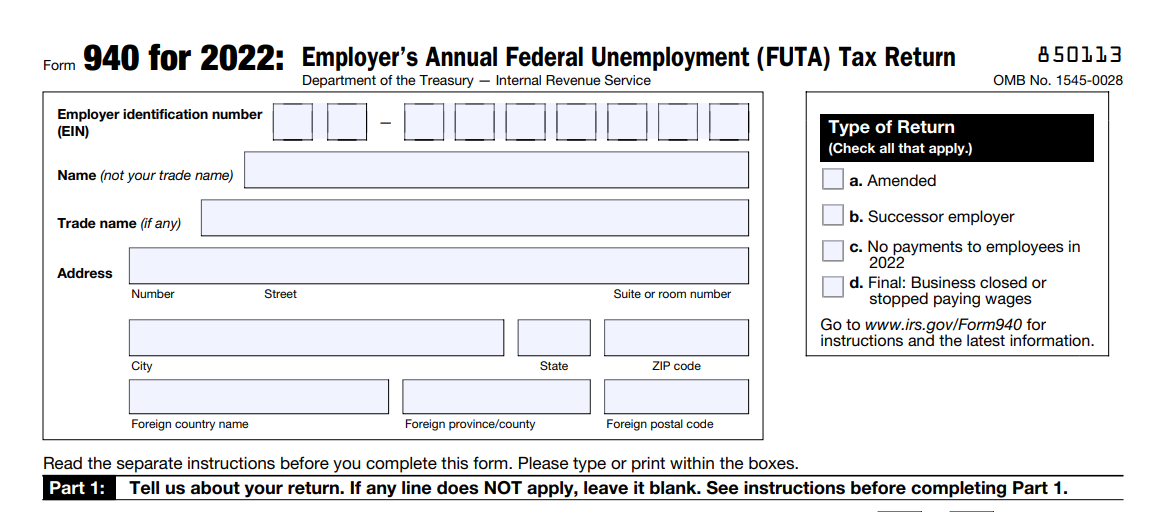

Form 940 - Employer’s Annual Federal

Unemployment (FUTA)

Tax Return

Form 940 is the federal unemployment tax annual report. Employers must report and pay unemployment taxes to the IRS for their employees.

Get quick processing and instant notifications on IRS approval when you e-file Form 940. It only takes a few minutes.

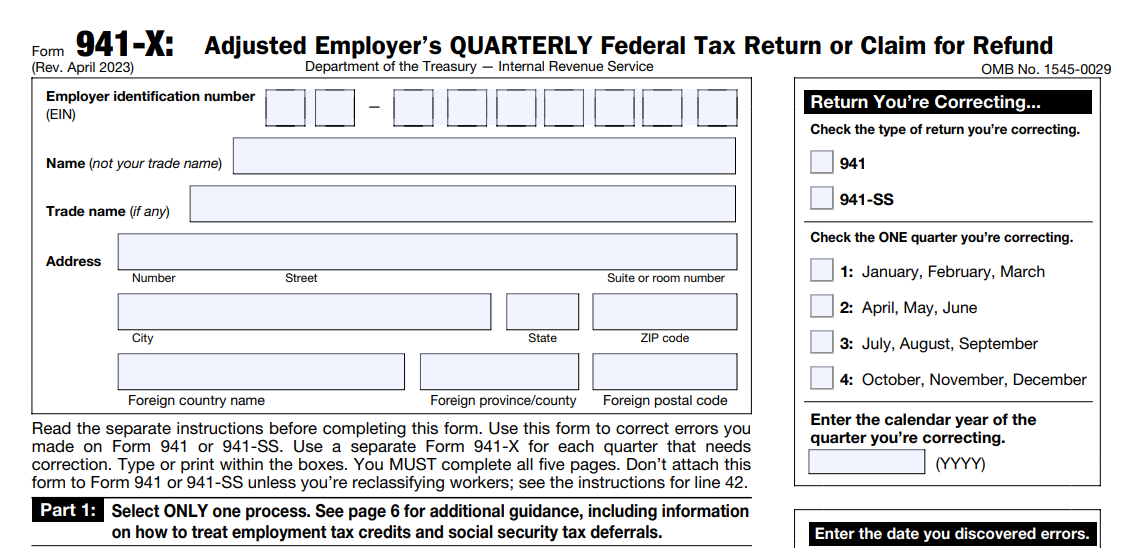

Form 941-X - Adjusted Employer's Quarterly Federal Tax Return or Claim for Refund

Form 941-X can be used to make corrections to Form 941. If you have figured out the errors on your previously filed Form 941, you should use Form 941-X to correct those errors.

You have to file Form 941-X with the Underreported taxes and Over Reported taxes.

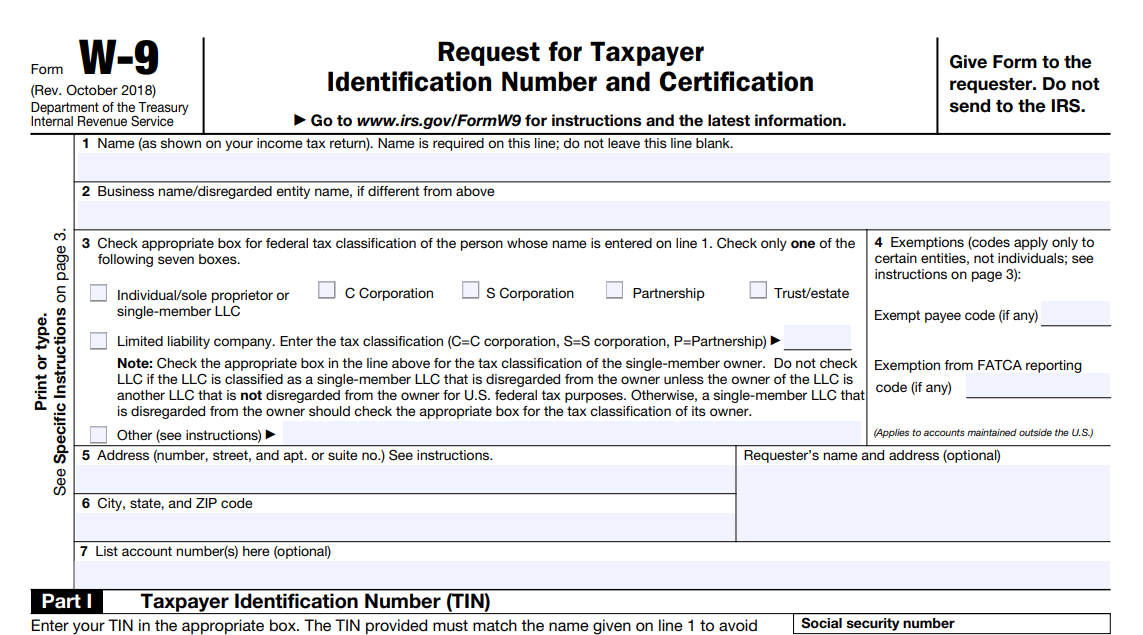

Form W-9 - Request for Taxpayer Identification Number and Certification

Form W-9 , also known as Request for Taxpayer Identification Number and Certification, is used by payers to obtain TIN information from the individuals or entities to whom they have made payments and are required to file 1099 forms for them. W-9 Manager offers a comprehensive platform for businesses to request and collect W-9 online from their recipients and manage them in one place.

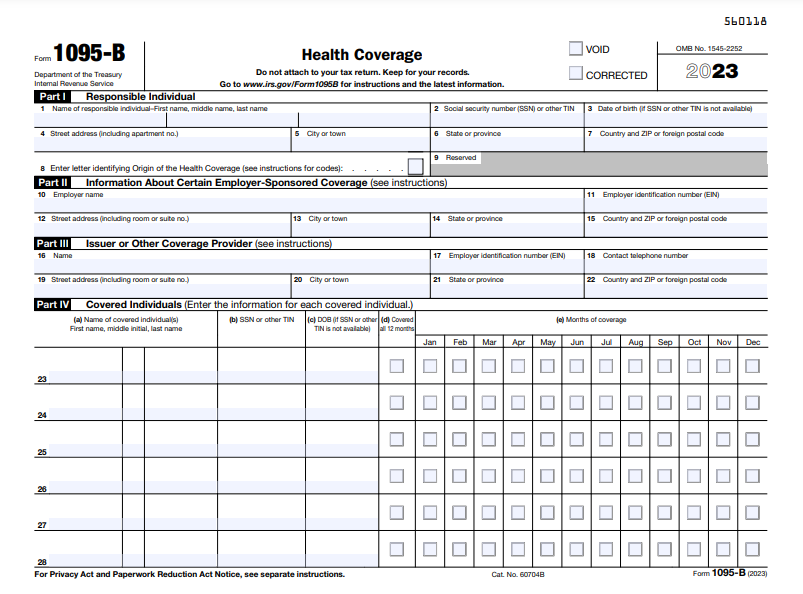

Form 1095-B - Health Coverage

Form 1095-B is used by the health coverage provider and small business (less than 50 full-time employees) to report the minimum essential coverage offered to the employees and individuals during the calendar year.

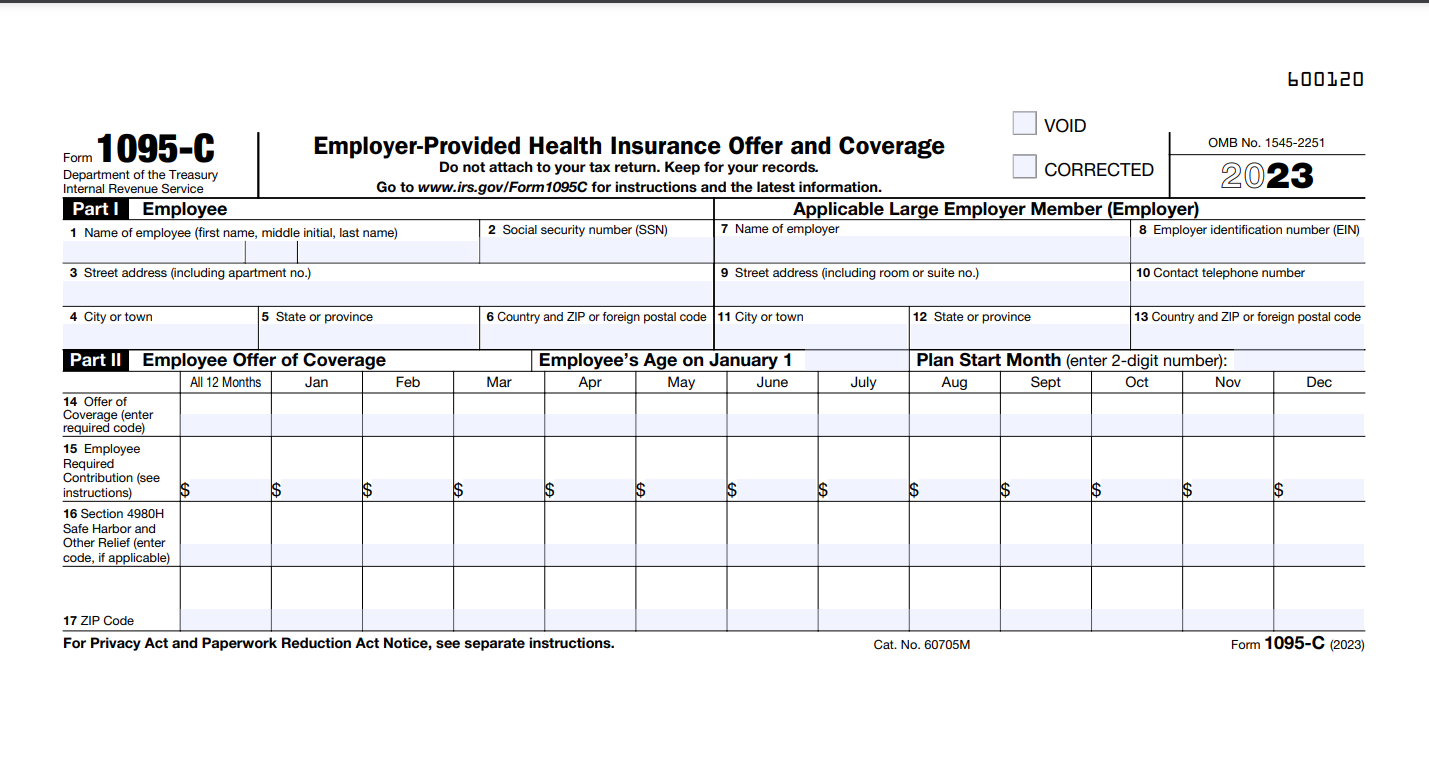

Form 1095-C - Employer-Provided Health Insurance Offer and Coverage

Form 1095-C is filed by the Applicable Large Employers (typically have 50 or more full-time employees) to report the information about their employee's health coverage required under the section 6056 (Employer shared responsibility provisions) to the IRS.

Why Choose ExpressEfile?

ExpressEfile’s parent company, SPAN Enterprises, is a trusted, IRS-authorized e-file provider. Our software gives small business owners a quick, easy, hands-on filing experience for the lowest price in the industry. With 10 years of experience behind us, ExpressEfile works closely with the IRS and ensures that your information is safe and secure.

Complete Filing in Minutes

Instant IRS

Approval

Real Time

Notifications

Built Error Check

Lowest Price

Email & Chat Support

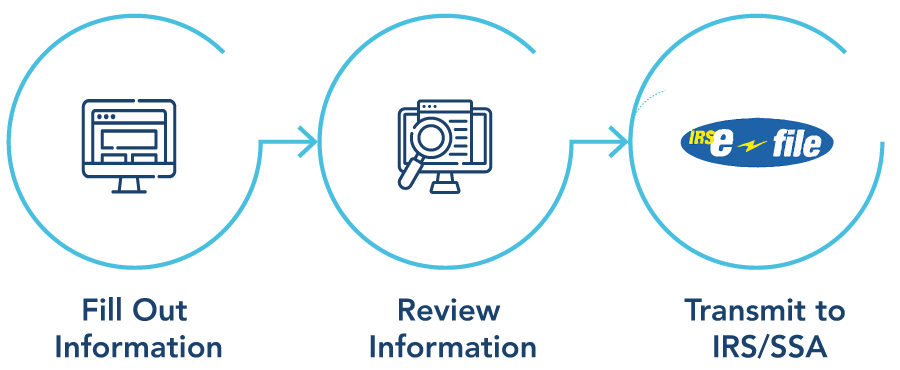

E-file Forms 941, 1099-NEC, 1099-MISC, W-2, 940 and ACA Forms with ExpressEfile

Choose your form |

Fill in details |

E-file directly with the IRS |

TaxBandits takes care of your Federal Tax Payments too!

TaxBandits now offers EFTPS payments, streamlining your federal tax payment process directly through their platform. Easily manage your federal tax payments directly from the TaxBandits platform, reducing the need for multiple systems and

manual processes.

Integrate TaxBandits API with Your Software!

TaxBandits API offers a convenient option for businesses and software providers to facilitate seamless e-filing of tax forms right from their portal or application.

The developer-friendly API enables the automation of the W-9 collection process. Moreover, the 1099 API serves as a perfect solution for automating various aspects of 1099 filing and recipient copy distribution, ensuring both federal and state compliance.

Get Started NowOur Integrations with Many Leading Accounting Software

XERO

We support Xero 1099 Integration, which allows you to quickly sync your 1099-qualified vendors and payments with our software for year-round e-filing, 1099 corrections, and more!

E-filing Form 1099 doesn't get any easier than this!

QuickBooks®

We also offer QuickBooks 1099 integration, allowing easy syncing of data from QuickBooks® with our software to quickly e-file 1099 Forms and corrections year-round for qualified vendors and payments.

Zoho Books

ExpressEfile now supports Zoho Books 1099 Integration, allowing you to e-file easily and securely by importing data from your Zoho Books account. Furthermore, we instantly transmit a printed copy of your 1099 Form 2024 to your contractors.

FreshBooks

ExpressEfile features FreshBooks 1099 Integration, which allows you to quickly and easily integrate your FreshBooks data with our software and promptly e-file 1099 Form 2024 instantly without any hassle.

E-Filing Partner

Sage Intacct 1099 Integration

We've partnered with Sage Intacct 1099 to offer a direct, seamless integration. This enables Sage Intacct users to simply and securely import and e-file Forms 1099-NEC, 1099-MISC, and other

tax forms.

Testimonials

Helpful Resources

Form 1099 Filings for Gig Workers

Learn about the tax forms that 1099 gig workers need to file to stay compliant with the IRS.

Form 1099 for Independent Contractors

Check out the forms and associated taxes for 1099 independent contractors to stay IRS-compliant.

Form 1099 Filing Requirements For LLC

Does an LLC receive a 1099? Learn about the 1099 filing requirements and associated tax forms.

Form 1099 for Rental Income & Payments

Know about the filing requirements of the 1099 form for rental income and the new changes for the 2024 tax year.

W2 vs 1099

Gain a comprehensive understanding of how W2 vs 1099 forms differ and their tax implications.

W2 vs W4

Understand the difference between the Form W-2 vs W-4, and Learn about their reporting purpose and filing requirements.