How to Correct Errors on 941 Using Form 941-X

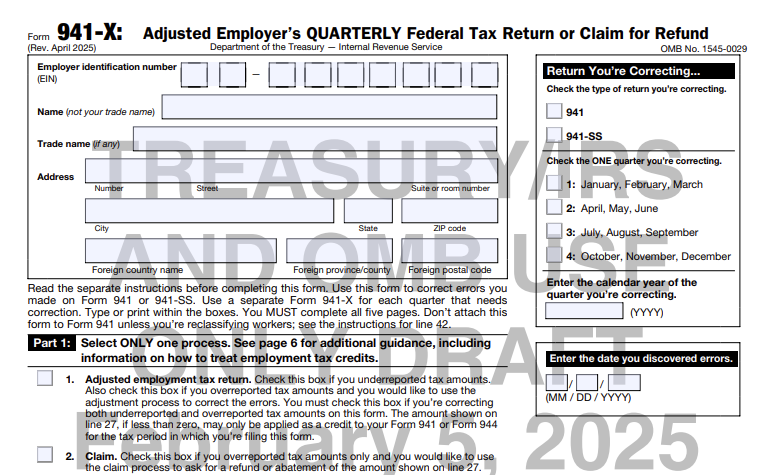

Form 941-X: Adjusted Employer's QUARTERLY Federal Tax Return or

Claim for Refund

Last Updated:

March 13, 2025

Form 941 Q2 Deadline is on

August 02, 2021

Form 941-X: A Complete Guide

Form 941-X is used to make corrections to errors discovered in the previously filed 941 tax returns.

Refer to the below topics to learn more about Form 941-X:

1. What is Form 941-X?

IRS Form 941-X, Adjusted Employer's Quarterly Federal Tax Return or Claim for Refund Form, can be used to make corrections to form-941. If you have figured out the errors on your previously filed Form 941, you should use Form 941-X to correct those errors.

Note: You need to file separate Form 941-X for each Form 941 that you want to correct.

You have to file Form 941-X with the following details.

- Underreported taxes - Reported less amount than the exact amount

- Overreported taxes - Reported more amount than the correct amount

You have to make a tax payment while filing Form 941-X if it is for underreported taxes. While you report overreported taxes using Form 941-X, you can either claim a refund or adjustment for the next tax return.

2. When to use Form 941-X?

You can file Form 941-X if any of the following amounts are misreported on your previously submitted Form 941.

- Wages, tips, and other compensation

- Income tax withheld from employee's paycheck and extra compensation

- Taxable social security wages

- Taxable social security tips

- Taxable Medicare wages and tips

- Taxable wages and tips subject to Additional Medicare Tax withholding

- Qualified small business payroll tax credit for increasing research activities

If you have reported the incorrect number of employees who received wages or Part 2 of Form 941, there is no need to file Form 941-X.

3. Types of errors that you can correct using Form 941-X

The following errors can be corrected using the Form 941-X:

- Underreported amounts ONLY

- Overreported amounts ONLY

- Both underreported and overreported amounts

4. What is the deadline for filing Form 941-X?

No specific deadline is stated by the IRS to file Form 941-X. However, it must be filed at the time when you discover the errors made on your prior Form 941. There is a time frame for reporting the overreported and underreported amounts. This time frame is called "period of limitations".

As per the period of limitations, Form 941 for the calendar year is considered to be submitted on March 315 of the succeeding year, even if filed before that date.

You can correct the over reported taxes on your previously filed Form 941 using the 941-X Form within three years from the date you filed Form 941, or two years from the date you paid the tax reported on Form 941.

You can correct the underreported taxes using Form 941-X within three years from the date Form 941 was actually filed.

5. Is there any penalty for underreporting taxes?

There is no penalty or interest for correcting unreported amount if you do the following:

- File on time

- Pay the amount that is shown on Line 20 when you file Form 941-X

- Mention the date when you found the error

Clearly explain your corrections You are subjected to pay interest if the following applies to you:

- The underreported tax is related to the calculation of a prior period

- You deliberately underreported taxes

- You received a notice and payment demand from IRS

- You got a Notice of Determination of Worker Classification

Note: If you get this notice even after you file Form 941-X, you can reply with a valid explanation.

6. Where to mail Form 941-X?

The mailing address for Form 941 X entirely depends on your business location.

Note: The IRS has introduced e-filing of Form 941-X to make the correction process more quick and secure. You can now file 941-X online to correct previously filed 941.

If you still choose to paper file Form 941-X, have a look at the below table to know where to mail your Form 941-X.

| If you are in: | Mailing Address |

|---|---|

Connecticut, Delaware, District of Columbia, Florida, Georgia, Illinois, Indiana, Kentucky, Maine, Maryland, Massachusetts, Michigan, New Hampshire, New Jersey, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, South Carolina, Tennessee, Vermont, Virginia, West Virginia, or Wisconsin |

Department of the Treasury, |

Alabama, Alaska, Arizona, Arkansas, California, Colorado, Hawaii, Idaho, Iowa, Kansas, Louisiana, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Oklahoma, Oregon, South Dakota, Texas, Utah, Washington, or Wyoming |

Department of the Treasury, |

No legal residence or principal place of business in any state: |

Internal Revenue Service, |

There is a special filing address for exempt organizations; federal/state/local government entities, and Indian tribal governmental entities, regardless of location: |

Department of the Treasury, |

E-File Form 941 with ExpressEfile

ExpressEfile lets you E-file Form 941 easily and quickly. It takes only a few minutes to E-File your 941 directly with the IRS.

ExpressEfile offers the lowest price of $5.95 for filing Form 941.

E-File 941-X Now