Form 941 First Quarter Deadline is April 30, 2024.

E-File Now

Form 1099-NEC Due Date for 2024

Tax Year

This article covers the following topics:

- Form 1099-NEC Due Date

- Penalties for not filing Form 1099-NEC

- E-File 1099-NEC in less than 5 minutes

Deadline to file IRS Form 1099-NEC for 2024 Tax Year

Updated on November 08, 2024 - 1:30 AM by Admin, ExpressEfile

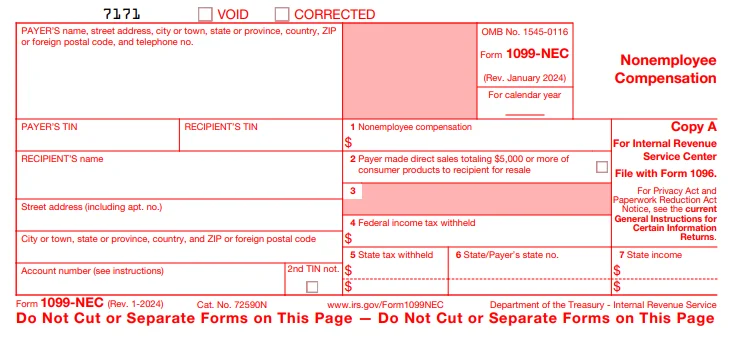

For the 2024 tax year, there’s a change in reporting nonemployee compensation. The IRS has released a new form, Form 1099-NEC (although it’s been used before some years) to report only nonemployee compensation

Read on to learn more about the due date to file Form 1099-NEC and more.

1. What is Form 1099-NEC?

Form 1099-NEC is a new IRS form that allows employers to report compensation of over $600 made to independent contractors or other nonemployees. Previously, nonemployee compensation was reported on Box 7 of Form 1099-MISC, but the IRS has recently released Form 1099-NEC as a replacement.

Employers should file Form 1099-NEC if they paid a nonemployee or independent contractor more than $600 for their services during the tax year.

2. When is the deadline for filing Form 1099-NEC?

Payers who have made payments to nonemployees for their services must file Form 1099-NEC. Also, they have to send copies of the form to the recipients before the deadline. Below is the deadline for Form 1099-NEC:

| Description | Deadline |

|---|---|

Paper Filing |

January 31, 2025

|

Sending Recipient Copies |

January 31, 2025 |

E-Filing |

January 31, 2025 E-File Now |

3. Penalties for Not Filing Form 1099-NEC on time

The best way to avoid IRS penalties on Form 1099-NEC is to file accurately

and on time.

The penalty for missing the 1099-NEC deadline is $60/return. If you file more than 30 days late, the penalty increases to $130/return. After August 1st, the penalty goes up to $330/return.

4. How to file Form 1099-NEC?

Form 1099-NEC can be filed either electronically or by paper.

- Paper filing: You can fill out the form manually and mail it to the IRS mailing address before the due date. However, you may not be able to get the status of your return whether it’s accepted or not. Also, since you are filing it manually, there might be chances of errors in the returns.

- Electronic filing: You can choose to file Form 1099-NEC electronically by using IRS-authorized e-file service providers. The IRS recommends filers to file forms electronically for a quick processing and accuracy in filing.

5. E-File Form 1099-NEC in less than 5 minutes

ExpressEfile makes filing Form 1099-NEC online easy. You will get the filing status instantly and may opt to mail recipient copies through ExpressEfile. Follow these steps and meet your 1099-NEC deadline easily.

- 1. Enter your Information Easily

- 2. Review Your Form

- 3. Transmit Form 1099-NEC Directly to the IRS

Get the lowest price in the industry when you e-file Form 1099-NEC for just

$0.80 per form.