IRS Form 941 Worksheet 4 For 2021

Employee Retention Credit for Q3 2021.

E-file Form 941 for the lowest price ($5.95)

with ExpressEfile. E-file Now

Form 941 Worksheet 4 For 3rd Quarter 2021

Updated on September 21, 2021 - 10:00 AM by Admin, ExpressEfile

Form 941, Employer's QUARTERLY Federal Tax Return, filed by employers in the United States has seen multiple revisions this year due to the COVID-19 pandemic. The IRS has revised Form 941 for quarter 2,3,4, 2021.

The IRS has adjusted the worksheets needed for the 3rd quarter of 2021 to calculate the Employee Retention Credit. If you’re an employer who is likely to apply for the COVID-19 tax credits, you must know about Form 941 Worksheets and how to use them. Check below to know more about worksheet 4.

1. What are the Form 941 Worksheets?

Under the CARES Act and now under the American Rescue Plan Act, there are COVID-19 related tax credits available for employers to claim. These include sick and family leave credits, employee retention credit, and the COBRA premium assistance credit. Employees that claim these credits during the quarter are required to calculate the refundable and nonrefundable portions of these credits on Form 941. The IRS designed Worksheets 1-5 to help employers calculate their credits.

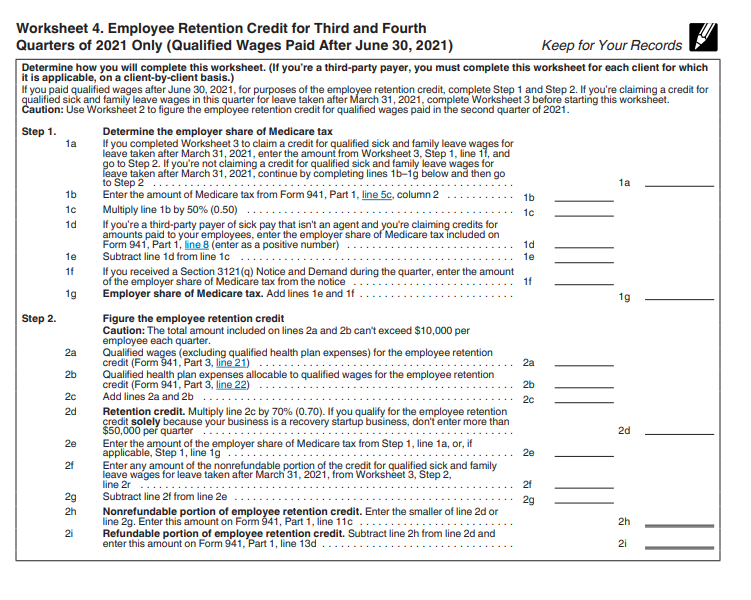

2. What is the Purpose of Form 941 Worksheet 4?

Worksheet 4 was added to the Form 941 instructions last quarter, but it was not needed for the second quarter of 2021 because it is specifically needed to calculate the Employee Retention Credit for the third and fourth quarters of 2021. This will replace Worksheet 2, as Worksheet 4 is designed to calculate all qualified wages paid after June 30, 2021.

3. How to Fill out the 941 Worksheet 4 for 2021

For employers filing Form 941 for the third quarter, Worksheet 4 will be new to them. Last quarter, Worksheet 2 was used to calculate the refundable and nonrefundable portions of the Employee Retention Credit (ERC).

For the upcoming third quarter reporting, employers will use Worksheet 4 to calculate the ERC, it applies to any qualified wages paid after June 30, 2021.

Here is an overview of Worksheet 4 and the steps for using it successfully.

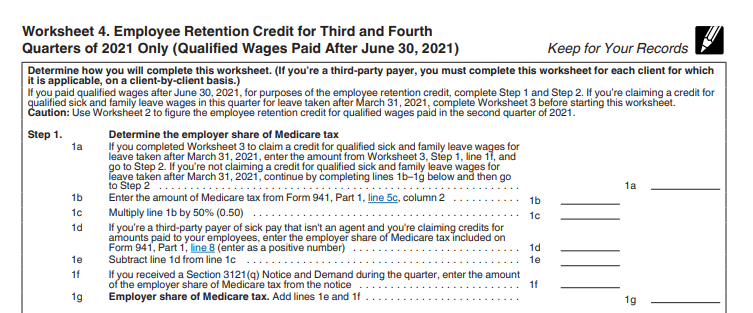

Step 1:

Please note that if you are claiming credit for qualified sick and family leave wages this quarter, you should complete Worksheet 3 first.

-

Line 1a:

Whether or not you are claiming credit for qualified sick and family leave wages will affect how you complete line 1a and the entire first step of the worksheet. Here are your two options for completing this line:

- If you are claiming credit for qualified sick and family leave this quarter, enter the value from Worksheet 3, step 1, line 1f and go straight to step 2.

- If you are NOT claiming credit for qualified sick and family leave wages, complete each line of step 1 (1b-1g) before continuing to step 2.

-

Line 1b:

Enter the value from Form 941, Part 1, line 5c, column 2

-

Line 1c:

Multiply line 1b by .5

-

Line 1d:

If you are a third party payer of sick leave (not an agent) enter the value from Form 941, Part 1, line 8

*This must be a positive number

-

Line 1e:

Subtract the amount on line 1d from 1c

-

Line 1f:

Did you receive a Section 3121(q) Notice and Demand this quarter? If so, enter the employer share of Medicare tax given on the notice.

-

Line 1g:

Total the amounts on lines 1e and 1f. This will be the total employer share of Medicare tax.

Step 2:

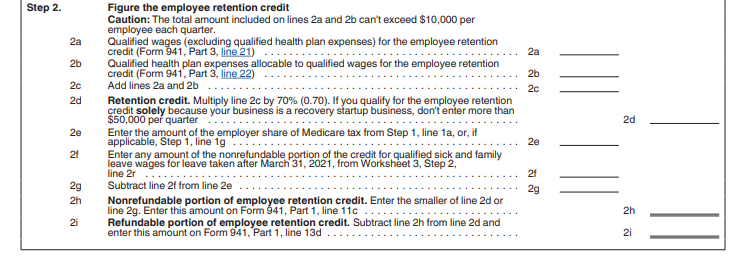

Now that you have established the employer share of Medicare tax, you will calculate the employee retention credit in step 2 of the worksheet.

-

Line 2a:

This is the qualified wages for the employee retention credit, enter the amount from Form 941, part 3, line 21

-

Line 2b:

This is the qualified health plan expenses allocable to wages for the employee retention credit. Enter the amount from Form 941, Part 3, line 22.

-

Line 2c:

Total up the amounts on line 2a and 2b

* Please note that if you are a Recovery Startup Business, the amount entered here cannot be greater than $10,000 per quarter.

-

Line 2d:

Multiply line 2c by .7 to get the retention credit.

* Please note that if you are a Recovery Startup Business, the amount entered here cannot be greater than $50,000 per quarter.

-

Line 2e:

Enter the amount the employer’s share of Medicare taxes from step 1, line 1a or step 1, line 1g (whichever amount is applicable to you).

-

Line 2f:

Enter any amount of nonrefundable credit for qualified sick and family leave wages from Worksheet 2, step 2, line 2r.

-

Line 2g:

Subtract the amount from line 2f from the amount on line 2e

-

Line 2h:

Enter the lesser amount from either line 2d or line 2g, this amount will need to be entered on Form 941, Part 1, line 11c. This is the nonrefundable portion of the employee retention credit.

-

Line 2i:

Subtract line 2h from line 2d and enter this amount on Form 941, Part 1, line 13d. This is the refundable portion of the employee retention credit.

4. When is the deadline to file 941 for 2021?

- IRS Form 941 Due date for 3rd quarter is on - November 01, 2021

- It is important to know which tax year and quarter you are filing as this will determine which type of Form you need to file

5. E-file Form 941 In Minutes With ExpressEfile

As the reporting requirements for COVID-tax credits become more complex, so does Form 941. Filing a paper copy of this form with the IRS is no longer feasible. With all the manual calculations required, there is a big margin for error. The best option is to file this form electronically. ExpressE-File offers a simple and accurate e-filing process.

You can count on our built-in data checks to catch the common errors that often go unnoticed when filing a paper form. ExpressEfile also allows you to get instant updates on the status of your form, this definitely isn’t an option if you file a paper copy. With the lowest pricing available, starting at just $5.95, E-file Form 941 in minutes with ExpressE-File!